TreasuryApps developed a new Treasury Management Systems (TMS) for Corporates called TreasuryApps TMS. Treasury departments improve productivity, automating key activities and processes and obtaining strategic information that helps them to make better decisions—and Treasurers becomes more strategic in the process.

TMS complexity and costs are barriers that some Treasurers do not want to deal with, so they stay away from TMS implementations and prefer to continue using Excel. TreasuryApps user-friendly and affordable TMS and easier-implementation approach allow companies to go live in weeks rather than months, increasing corporate return on investment (ROI) exponentially.

TreasuryApps was founded by Gerardo Lopez Haro to improve the technology used by treasury departments and help them to grow into more strategic roles. In his Corporate Treasury experience of more than 20 years, he found that Treasury is mired with manual processes that take hours daily; most of the time, managers react to changes in the business rather than proactively prepare for them, and they spend too much time troubleshooting spreadsheet errors rather than focusing on Treasury transformation initiatives.

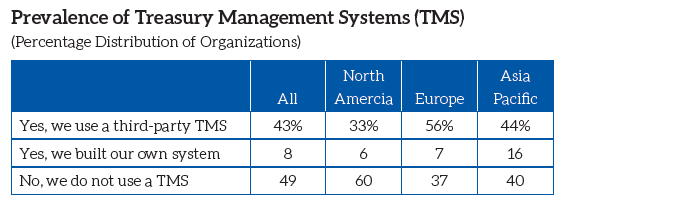

Understanding our story requires to understand the context of the TMS market in the US. This is a quote from a survey done in 2016 by Bloomberg and the Association For Financial Professionals (AFP):

“… More European companies (63 percent) use a TMS compared to organizations in North America (40 percent) and the Asia-Pacific region (60 percent).

More than 71 percent of companies with a TMS said their cash visibility was good to very good, demonstrating that using a TMS automates processes, improves cash visibility, and enables the Treasury department to spend more time on decisions that increase value to the firm. And, more than half of the companies with a TMS said the greatest single benefit is either more efficiency or that Treasury is able to do more with less. With a TMS, Treasury can spend more time on analysis, increase controllership, and fulfill its mandate to be more strategic ….”

Gerardo created TreasuryApps TMS to address three painful reasons that prevent most US companies from switching to a TMS:

1) TMS are very expensive

2) Implementations are expensive and difficult, and many experienced people are needed

3) Existing TMS are not flexible enough. Companies usually have to adjust to restrictions imposed by TMS

In these circumstances, TreasuryApps brings to the market a SaaS TMS that:

- Even mid-market companies can afford

- Can be implemented faster

Improving Productivity In Treasury Requires Building A Strong Business Case:

The greatest single benefit of TreasuryApps TMS is process automation while analyzing large volumes of data and providing strategic information to decision makers. TreasuryApps suggests Treasurers build a case focusing on ROI using the following 5 possible areas:

- The productivity equivalent of the number of full-time employees needed to do what the TMS will do for their company, including the level of specialization needed (cash management, foreign exchange, account reconciliations, cash-flow analysts, international cash management, hedging, hedge accounting, etc). TreasuryApps TMS can substitute the work of at least 3 to 5 full-time employees

- Savings in interest expense and improvements in interest income

- Mitigating operational risks such as fraud, reporting errors, and financial risks such as earnings volatility, due to foreign exchange or interest-rate risks

- Savings in foreign exchange spreads and wire transfers using the intercompany netting module

- Worldwide cash allocation improvements with daily visibility of multicurrency cash balances. For example, maximizing intercompany lending over external borrowings or finding pockets of cash that are not invested properly

TreasuryApps Implementation Approach:

TreasuryApps reduces complexities and costs since:

- We analyze requirements very carefully and adapt to existing processes, rather than forcing companies to adapt to limitations of old TMS

- We help with a lot of the heavy lifting, uploading core system information and fine tuning the system

- Deliver a working prototype (pre-configured system)

Prepare a customer specific online training platform so users learn at their own pace

In this market, delivering a working prototype on Day 1 usually takes months of hard work and users get mad. When users save time in implementation and training because TreasuryApps did most of the work behind the scenes, users feel better and collaborate at higher levels of productivity and satisfaction.

Where is TreasuryApps Heading?

TreasuryApps continues developing initiatives that provide strategic information to Treasurers while reducing the workload of Treasury staff. Currently, we focus on 4 areas: Cash reconciliations, cash forecasting, risk management, and market analysis. Why?

- Large volumes of transactions create manual work and automation is the best tool to identify, analyze, and source strategic information

- Some companies with resources in excess do not produce cash flows because it is labor intensive and time consuming, so TreasuryApps continues automating complex processes that help companies of any size to create cash flows more easily

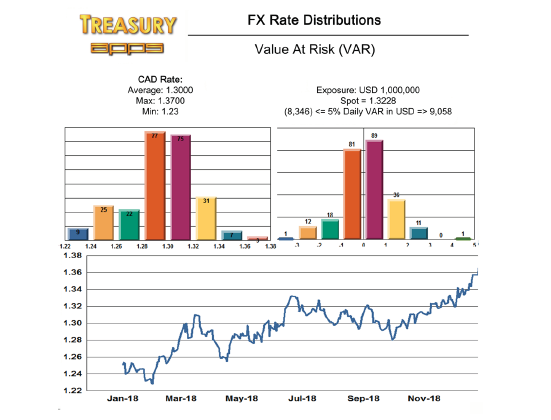

- Many Treasurers avoid hedging because it is complex. TreasuryApps continues automating many processes that help companies to identify risks and execute the hedges while complying with all regulations

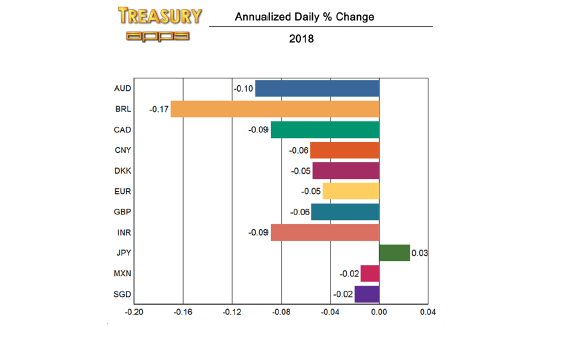

- Front office managers need market information to secure the best possible outcomes while trading