Wisconsin-based NVNG is a boutique investment advisory firm with a unique superpower: curating connections. Founded by Carrie Thome and Grady Buchanan in 2019, NVNG (Nothing Ventured, Nothing Gained) is on a mission to make Wisconsin’s venture ecosystem globally competitive by leveraging the power of strategic networks.

“We have the right national network connections that the state has been missing, in addition to providing the necessary capital for both funds and startups.”

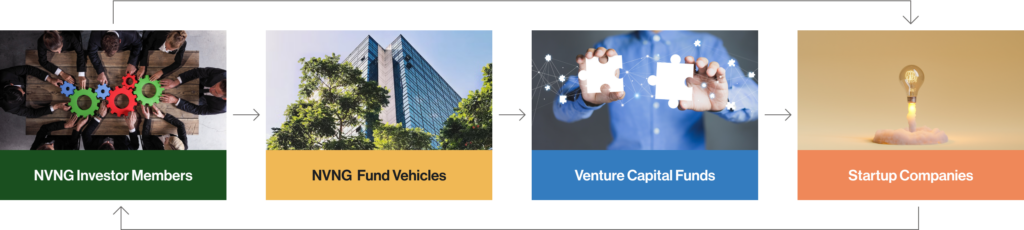

NVNG works alongside its members to offer exposure to venture capital firms and their underlying portfolio companies through fund-of-fund vehicles. Investors include those with strategic capital seeking financial returns from innovative ventures that fuel growth via vetted venture capital investment opportunities.

Thank you to MKE Tech for making this book possible, they are the voice and champion of Innovate® Milwaukee that unifies the community!

Carrie and Grady, both with backgrounds in institutional investing and a shared passion for entrepreneurship and the venture asset class, realized the pivotal role that connections play in fostering a thriving venture capital landscape. NVNG’s vision is built on the belief that the right networks, both within Wisconsin and beyond, can transform and grow the state’s venture ecosystem.

The managing directors’ long-time experience and diverse set of talents span decades of work in the institutional investment, technology transfer, venture capital, and startup sectors. NVNG operates as a disciplined guide and experienced connector intent on serving engaged and mutually beneficial communities of active investors, venture capital funds, and underlying portfolio companies.

NVNG has developed a model deeply rooted in the venture asset class, creating an ecosystem of investor partners, seasoned investment professionals, highly sought-after funds, and a community of well-vetted startups. This model is based on creating connections and networks between these parties and generates benefits that extend beyond financial returns.

“This model allows us to create new ways of attracting capital and supporting an ecosystem here that is very much in transition and deserving of the venture capital network that we can provide,” Grady asserts.

The success of NVNG’s Fund I is a testament to the founders’ commitment and their ability to leverage connections. Fund I, a fund-of-funds, has effectively bridged the vibrant Wisconsin startup community with fund managers from across the country.

The promise of NVNG to provide investors access to sought-after and well-performing venture funds, coupled with Carrie and Grady’s significant network and experience, played a crucial role in securing the capital that resulted in a $50 million Fund I.

“There is no reason that Wisconsin can’t have a thriving venture capital ecosystem,” shares Carrie. “We are confident that we have the right national network connections that the state has been missing, in addition to providing the necessary capital for both funds and startups.”

The firm’s investor partners are a mix of world-class innovative corporations, leading financial institutions, cutting-edge venture organizations, and forward-thinking individuals. These include West Bend Insurance, Johnson Financial Group, Baird, Exact Sciences, MKE Tech, CU Ventures, and Hydrite.

NVNG’s funds are focused on delivering returns, but they are also focused on fostering connections. The firm’s +Venture platform is a testament to this commitment. Through events, networks, communities, and investor-exclusive online tools, NVNG goes beyond being a traditional investment vehicle. The +Venture platform enriches the NVNG experience, offering value beyond financial returns. +Venture North is NVNG’s invite-only event, which brings together corporate innovation teams, venture capitalists, and startup founders for a day of learning, networking, and community building. It serves as a platform to showcase Wisconsin’s innovation ecosystem, emphasizing the collaborative spirit that NVNG strives to foster. +Venture Wisconsin serves as a clearinghouse for Wisconsin’s most innovative startups, providing an opportunity for entrepreneurs to showcase their innovations and for investors to discover the next big thing.

+Venture Partners serves as NVNG’s investor-only portal, which goes beyond data and programming. It serves as a portal to connections, providing access to fund managers, portfolio startups, and other investors and innovators.

The fund, the network, and the +Venture platform all come together to create a catalyst for connection and collaboration. And, with the addition of significant direct investment in Wisconsin startups in 2024, NVNG’s impact on the Wisconsin venture economy will only continue to grow.