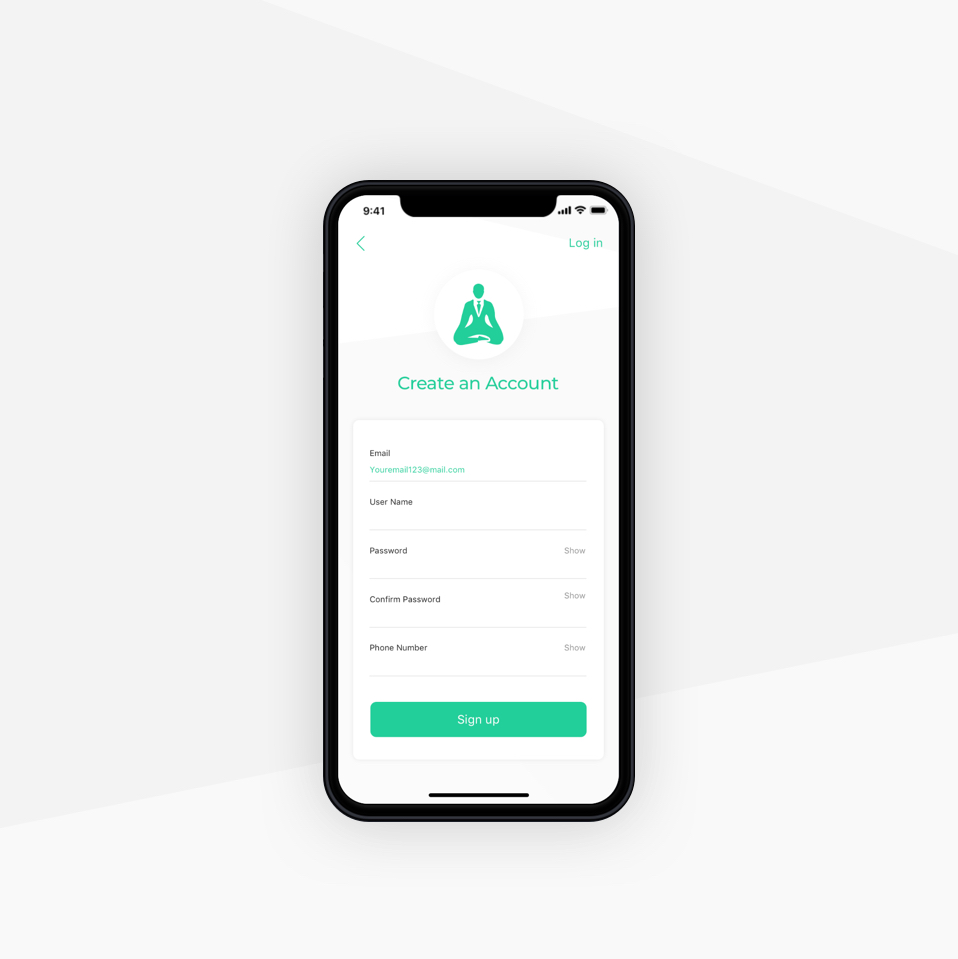

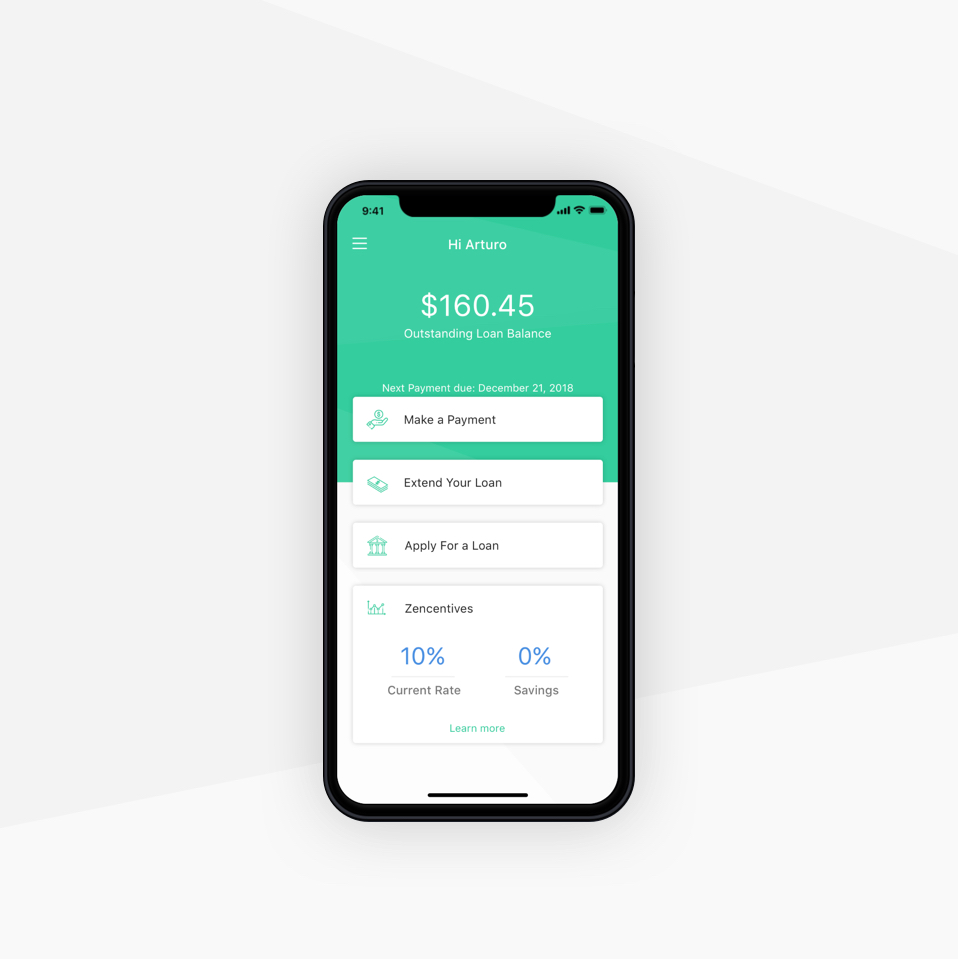

Guru the friendly lender is a mobile payday lending application, helping people get out of these financial troubles by providing them with small affordable loans and educational resources to help improve their financial situation.

Problem

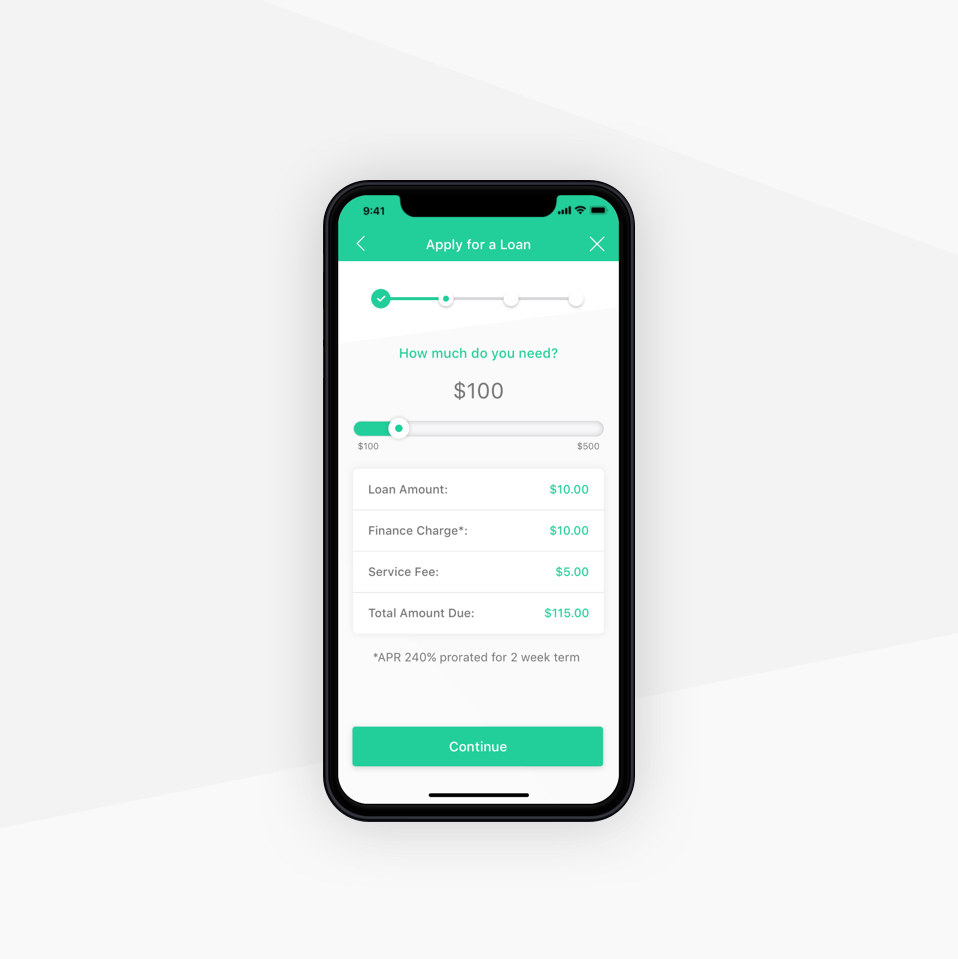

People need access to credit in order to help pay their bills and take care of their families, but the average payday loan is inconvenient and tends to keep borrowers in a cycle of debt. With a study showing over 80% of payday loans rolled over or re-borrowed, and only 14% of borrowers actually able to afford to pay them back, mostly due to exorbitant rates.

Solution

Guru is the first incentive driven payday lending service in the market offering a friendly alternative to those in need. With an incentivized repayment program, the borrower is rewarded with an incrementally lowered interest rate with every loan payed on time. In addition to making it more affordable and accessible for people to qualify and payback their loans, Guru is dedicated to educating users on how they can improve their economic situation with free content and access to educational resources. How did Guru Financial come to be?

Around two years ago, we started kicking some business ideas around, mostly in the financial technology sector (FinTech). Like any aspiring team of entrepreneurs, we set out to identify a problem or “gap” and propose a solution or alternative to the status quo. Sure enough and by definition, we noticed that the most neglected space in the financial services sector was the “underbanked”. We came to realize very quickly that for consumers with little to no credit, there were limited options to fairly and efficiently borrow money. We looked at what was out there and decided that we could create a better product. Our sights were set on disrupting the payday lending sector and all its stigmas by offering a true alternative.

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!Milestones

- Successfully completed closed-loop beta test

- 29 live users & $2500 in issuances

- 100% success rate on identifying intentionally falsified information

- Average application time: 4 min. 50 seconds (full approval within 10 minutes)

- 100% success rate linking bank accounts (including community banks)

- Transactions on both iOS & Android

- Selected as a top 100 Startup for Emerge Americas Startup Showcase Exhibition

- Winner of the Miami Herald 2019 Startup Competition

Next steps

Next steps are to successfully launch the platform. While we have conducted a beta tests with 29 users and have circulated approximately $2,500 through the app we are not yet live on the app store. We are also in the process of negotiating several software license opportunities with major players in this space. We see the potential of our app as a white-label solution as complementary revenue stream.