Greater Newark Enterprises Corporation (GNEC) is a Newark-based non-profit certified community development financial institution (CDFI) with a proven record of delivering capital and microenterprise services to disadvantaged microentrepreneurs in the northern New Jersey areas of Essex, Hudson, Passaic, Bergen, Middlesex, Union and Monmouth counties of New Jersey. GNEC’s primary purpose is community development, and the organization carries out its mission by financing small business growth and development and providing financial services to disadvantaged residents in New Jersey.

GNEC’s products are designed to operate in the void between mainstream lenders (banks and other regulated financial institutions) and unregulated lenders (payday and online money lenders). Our aim is to provide options to our clients that do not have access to mainstream finance or technical expertise, to prevent them from having no fair financial options or from having to approach the predatory lending market. GNEC’s portfolio, products, and service reflect our commitment to the people and area in which we live and serve. Since its inception, GNEC has provided over 145,000 hours of technical assistance services to over 6,000 unique individuals, lent over $4 million on-book and over $15 million off-book. Of this amount, 63% went to African Americans, 24% Hispanics, 8% Whites and 5% Asians. Our loan clients have been 51% men and 49% women, with 41% being moderate-income, 31% low income, 14% very low income, and 93% to businesses located in moderate- to low-income census tracks. During 2020 and 2021 GNEC has provided technical assistance services to 700 unique individuals and loaned over $750,000 on-book and over $4 million off-book.

Through providing capital solutions, GNEC assists clients to build assets for themselves and their families. While access to capital often provides short term stability for our clients, our technical assistance has lasting benefits.

Since many of our clients face barriers in accessing the local business ecosystem, GNEC has designed its services to enable these barriers to be systematically removed. Our aim is to provide financial options so that no one must approach the predatory lending market. Our main lending products include:

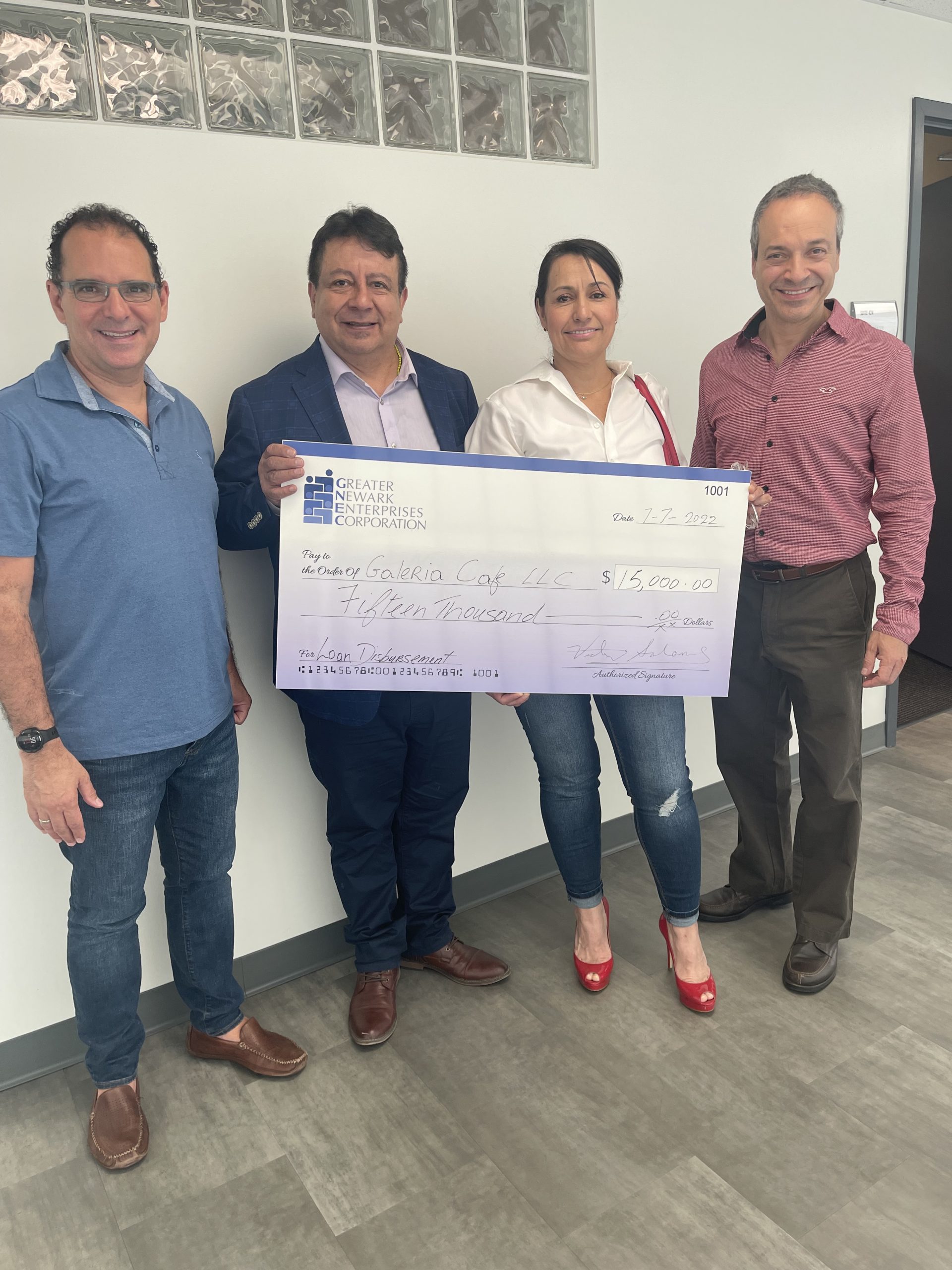

GNEC Business Builder Loan Program provides access to capital for small businesses that are unable to access full financing from the banks. These loans provide capital in the range of $15,000– $75,000 at competitive rates. On occasion, GNEC also partners with other CDFIs and sector specialists to provide loans of up to $100,000.

GNEC Dream Maker Loans are made for entrepreneurs who are seeking seed capital to take the first steps toward business ownership. These 2,000-$15,000 loans are designed to give startups capital to purchase equipment needed to launch a business or their initial inventory. The Entrepreneurs of Color Fund – Newark Program was launched in February 2022 to assist minority-owned businesses from Newark in the opportunity to access capital at highly competitive rates.

A key aspect of GNEC’s work is our delivery of technical assistance and business education programs throughout the year and through a variety of partnerships. GNEC’s BackStop program is a multi-tiered technical assistance program launched in 2022. Tier 1 provides bookkeeping services and access to Quickbooks through experts contracted by GNEC. Tier 2 is a partnership with Dun & Bradstreet to provide GNEC with access to business credit building services, while the newly launched Tier 3 focuses on providing website development and social media services by experts contracted by GNEC.