Deltacore Capital was established in 2018, after finding success in the very popular 2017 crypto bullrun. Since then their focus has been on consulting, educating on financial crypto literacy as well as being the General Partner for Deltacore Digital Assets LP, a multi strategy investment fund focused solely on digital assets.

Through the years Deltacore Capital has received multiple awards from BarclaysHedge for its monthly performance in the crypto market in addition to making it into the top Prequin’s top investment fund lists globally for 2020.

Deltacore Digital assets started out as a small five figure investment fund and since then has grown to a multi-million dollar investment fund. Since 2021, Deltacore Capital has opened an international investment fund, and expanded into licensing out several of its proprietary trading algorithms and indicators for risk management.

Deltacore Capital has strived to make an impact in the crypto community outside of its investment fund by helping to educate the public on financial literacy, blockchain technology and crypto investments.

These efforts have been seen in free crypto trading courses, webinars, speaking engagements and creating content for larger crypto outlets and educational companies.

Deltacore Capital are now in a period where the internet itself is being re-engineered to create the Internet of value, built on a foundation of trustless protocols and distributed ledgers. Behind this re-engineering is blockchain technology and digital assets.

Digital money and crypto-assets are becoming hyperfluid and exponentially more efficient, doing to finance what the Internet did to commerce and communications. This new step towards a digital world requires a deep understanding of the underlying technologies, assets, and markets in addition to proper management of a portfolio of digital assets.

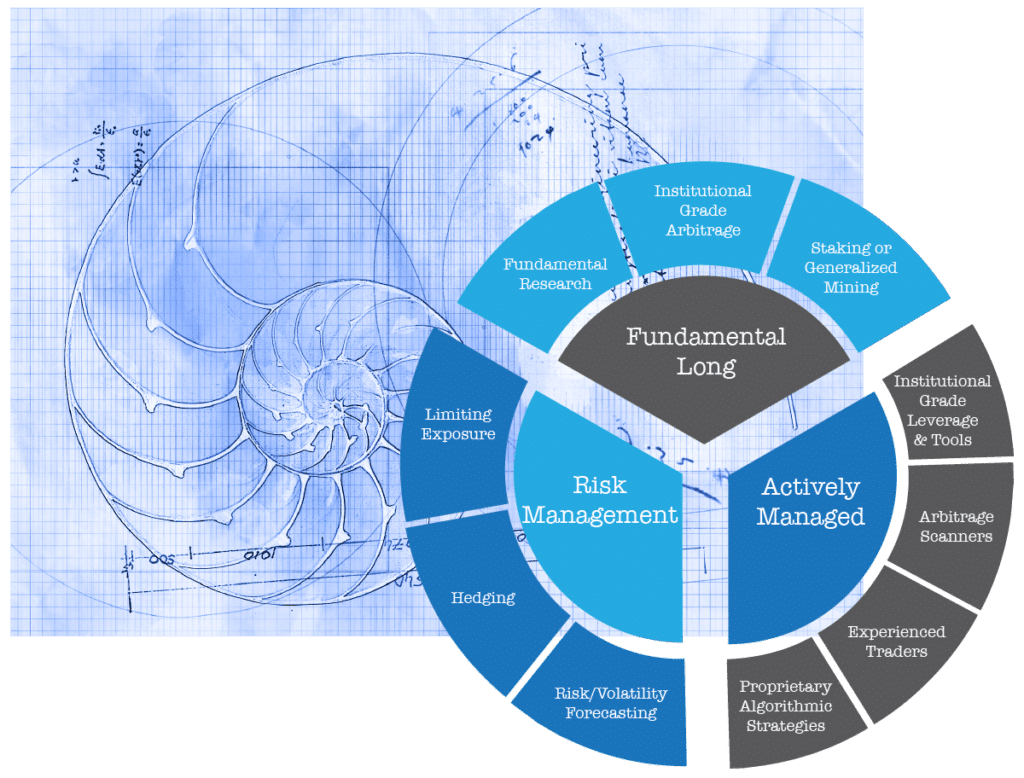

DeltaCore takes a bottom-up approach to create a blueprint for investing in digital assets and achieving your financial goals. Whether you are new to this technology or a savvy veteran, they provide a professional and personalized solution for you.

This blueprint to investing in the new digital economy is designed to ultimately execute sound investments with their clients’ best interests in mind with a focus on finding the middle-ground between a long-term fundamental value perspective and a short-term actively managed mindset, while keeping risk management core.