CREDPAGO- HAS BEEN A FORCE FOR CHANGE IN THE BRAZILIAN REAL ESTATE MARKET, SIMPLIFYING AND CUTTING THROUGH THE REDTAPE OF THE RESIDENTIAL LEASING PROCESS.

Founded in 2016, the company’s mission is to solve the difficulty of accessing efficient rental guarantees in a country with over 15 million rented houses.

The company is present in more than 700 cities, closing a new contract every 2-minutes.

By introducing the use of credit card’ data in risk analysis and as a payment method for guarantees, CredPago has not only innovated but also democratized access to housing.

Traditional security deposits and guarantors often prove unfeasible for many Brazilians. CredPago’s response came in the form of a disruptive product, distinguished by its ease and low cost.

Its story is marked by strategic partnerships and rapid growth. By 2018, just two years after its inception, the company recorded an impressive figure of 10,000 contracts under management.

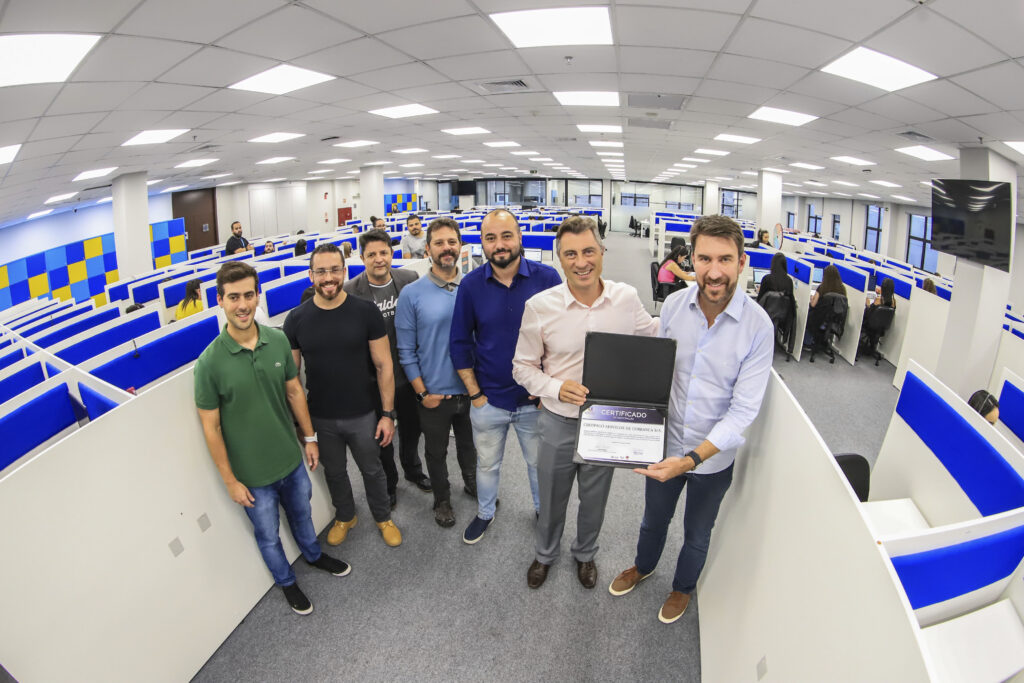

Validation came with selection for Endeavor’s Scale-Up and Scale-Up Fintech programs in 2019. That same year, CredPago expanded its influence with the inauguration of a new headquarters in Curitiba.

The resilience and adaptability of CredPago were tested and proven during the pandemic in 2020 when the company surpassed the milestone of 100,000 contracts issued and incorporated BTG Pactual into its corporate structure. In 2021, the merger with Grupo Loft further solidified its leadership position, impacting over 750,000 people with its lease guarantee solutions.

Among the innovations offered are electronic document signature and the contracting of lease guarantees without a guarantor, entirely online. “These products not only strengthen the relationship with real estate agencies and brokers but also expand the company’s reach, which continues to grow,” says Sandro Westphal, CEO of CredPago.

In the near future, CredPago is set to enhance its credit engine, integrating data from multiple bureaus with proprietary analytics to forge the market’s most sophisticated credit model. This advancement is expected to facilitate the approval of previously underserved customer segments. Additionally, the introduction of a novel collections system and the deployment of artificial intelligence models will significantly boost the team’s operational efficiency.