The way that we invest and trade value will fundamentally change as assets become digitized. tZERO is a technology company that is building the next generation capital markets platform, capable of tokenizing, trading and settling digital assets.

Our story began when Utah-based Overstock.com became the first major retailer to accept bitcoin as a payment method in early 2014, causing the company’s founder, Patrick Byrne, to recognize the promise of blockchain technology.

After becoming more familiar with the benefits to humanity possible with cryptocurrency, blockchain and other distributed ledger technology, Overstock created Medici Ventures, a wholly-owned subsidiary with the goal of advancing blockchain technology to democratize capital, eliminate middlemen and re-humanize commerce. To this goal, Medici Ventures has built a global blockchain keiretsu of pioneering and innovative companies like tZERO, which is introducing greater efficiency and transparency to capital markets by leveraging blockchain and smart contract technology.

In 2016, tZERO’s long-term vision for modernizing capital markets commenced when it provided the technology behind trading the world’s first public digital security, Overstock.com’s OSTKO (formerly OSTKP). Following the successful issuance of OSTKO, tZERO launched its security token offering (TZROP) in December 2017. Overstock tasked Saum Noursalehi, who was then president of Overstock after 12 years with the company, to lead tZERO as its CEO.

Having studied computer science at The University of Utah, Noursalehi has always had a strong interest in technology and his proven track record as an innovative leader helped tZERO through the highly publicized issuance of tZERO’s security tokens. To date, TZROP and OSTKO both trade on a trading venue powered by tZERO technology. tZERO’s security token offering (STO) was one of the first STOs on a decentralized public network that was conducted in full compliance within existing U.S. securities laws. Using the capital raised from the offering, Noursalehi formed teams for tZERO’s key business units: asset tokenization, the secondary trading platform for digital securities, as well as the cryptocurrency wallet.

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!From here, Noursalehi hired an experienced management team to help execute this business plan.

Asset Tokenization

tZERO’s proprietary technology can tokenize a company’s capital raise or existing capital structure, new or existing funds as well as illiquid assets such as real estate or fine art. This year, tZERO partnered with Entertainment Financing Company BLOQ FLIX to tokenize films and Alliance Investments to tokenize a luxury real estate development in Manchester, UK.

Secondary Trading Technology Platform

Secondary Trading Technology Platform: tZERO’s secondary trading platform powers market places for digital securities. One of these venues will be the Boston Security Token Exchange (BSTX), the world’s first fully regulated security token exchange, which was established by tZERO and its joint venture partner BOX Digital Markets in June 2018.

Crypto Unit

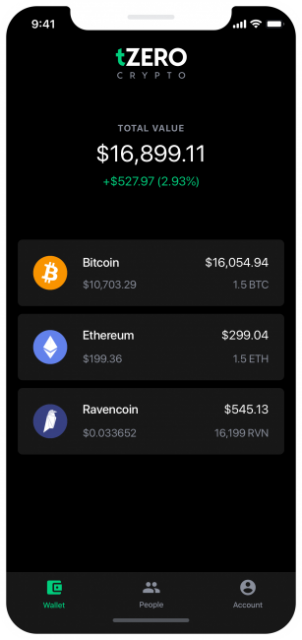

tZERO’s Crypto Unit launched a Crypto App, tZERO Crypto, in June 2019, allowing users to trade bitcoin (BTC), ethereum (ETH) and Ravencoin (RVN). Long term tZERO expects a variety of cryptocurrencies and digital assets to trade on this technology platform.

tZERO continues to work toward its vision of creating a robust blockchain-based ecosystem for investors to have venues to buy and sell digital assets, integrating the technology to tokenize assets (tZERO’s tokenization protocol technology) and establishing direct relationships with customers (subject to its wholly-owned subsidiary becoming approved as a retail broker-dealer).