SnapScan is more than just a smartphone app. It’s a contactless, mobile payment solution that makes it easy and safe to pay and receive payments in a store, online, at home, and on the go.

Our story

Founded in 2013, SnapScan gained traction at markets and coffee shops in Stellenbosch. The founding team had extensive experience in banking and mobile money. Their goal? To improve the payment experience for small business owners and their customers. At the time, the only payment options available for face-to-face sales was cards and cash. The first required expensive hardware, while consumers didn’t always carry enough of the second.

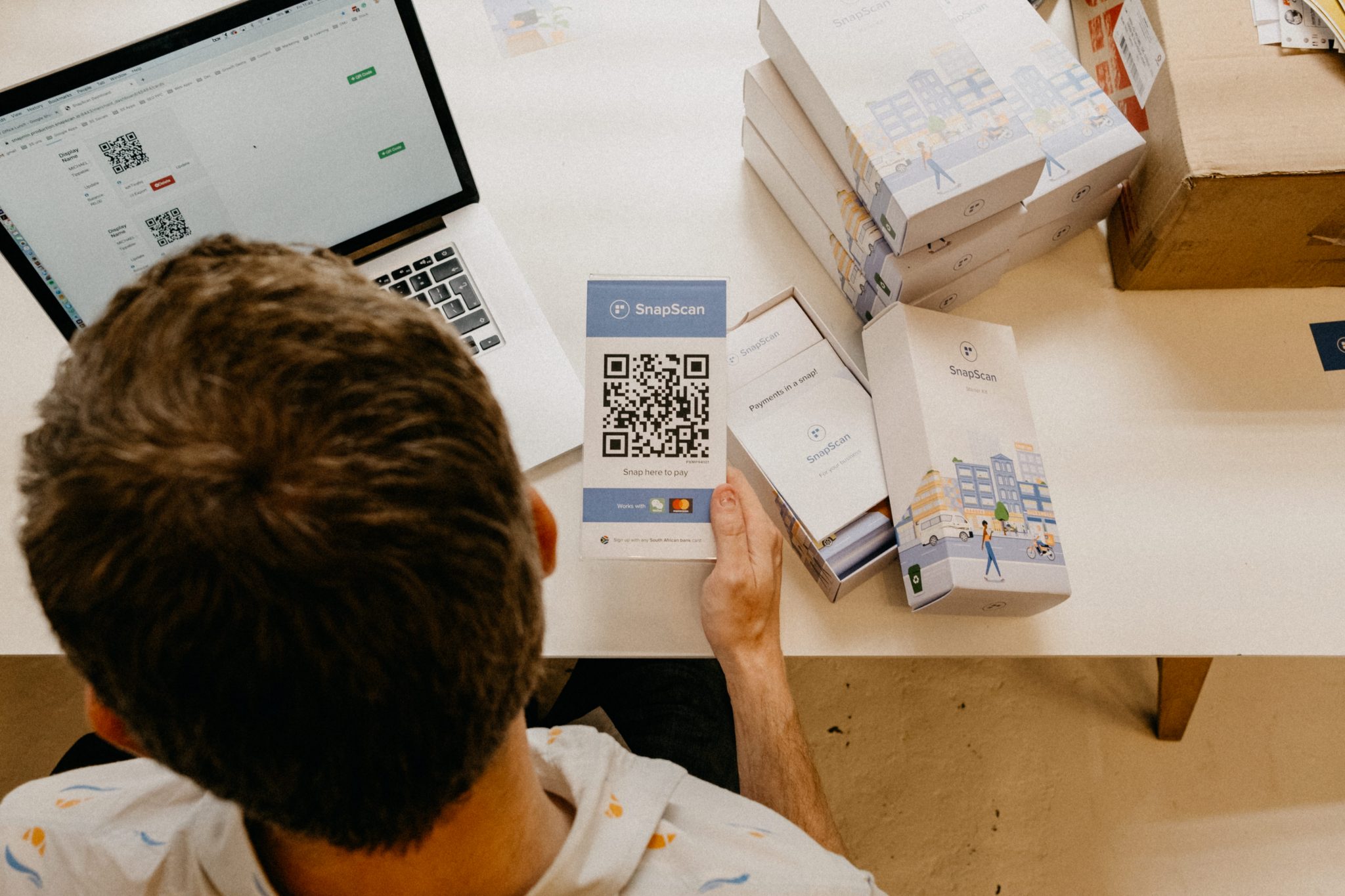

By incorporating digital payments into QR code technology, the team created a mobile app that would allow consumers to pay at their favourite businesses without having to carry around an endless amount of cash. Instead, they could load their credit card into the app, and use the app to pay. It also meant that small business owners no longer had to rely on expensive hardware to accept payments from their customers. Businesses could sign up and get their unique QR code (a SnapCode), which customers would scan to pay with their mobile devices.

Growth Opportunities

One of the first mobile payment solutions in South Africa, SnapScan was named MTN App of The Year in 2013. By partnering with Standard Bank, the company scaled its offering to reach more customers (both businesses and consumers alike).

As the company has grown over the years, so has our ecosystem of payment tools. We know that running a business can be overwhelming. So we’ve made it our mission to build payment solutions that are simple and convenient.

Our expanded offering now makes it easier for businesses to operate and accept payments in their preferred environment – whether that’s face-to-face, online or both. By making it simple for businesses to accept payments across channels, we allow them to focus on what they do best: selling their goods and services.

On the consumer front, we’ve expanded our mobile payment app offering to allow consumers to carry out several essential tasks from one app. Now, not only can consumers pay for goods at their favourite businesses, but they can also buy prepaid electricity and data, pay bills, donate to a cause close to their heart, pay for parking, and even make peer-to-peer payments within the app.

Changing Tides

Although our offering has evolved, the one thing that’s remained consistent is our passion for supporting small businesses in whichever way we can. The past two years have been particularly brutal for small business owners. Doors have closed as businesses struggled to attract customers. In response to this, SnapScan partnered with communities to create rewards programmes that would inject much-needed revenue into their local economy and keep businesses afloat.

The global pandemic has proven that the only way for businesses to survive is for them to be able to adapt to their circumstances. Our expanded offering allows them to do just that:

Pay Links enable them to get paid remotely, our ecommerce plugins allow them to easily accept online payments, while our physical SnapCodes remain a safe, contactless solution for brick and mortar retail stores.

Moving forward, we’ll continue to build innovative solutions that make payments simple for everyone moving. “We’re excited by the rapid adoption of mobile and digital payment methods over the past two years,” says CEO Chris Zietsman. “SnapScan’s short to medium-term focus is to build digital products for our consumers and merchants that facilitate the best possible digital interactions when making or accepting payments through mobile and digital channels.