Senso is a leading intelligence and engagement platform designed to help mortgage lenders increase interest income growth and lifetime value by proactively engaging borrowers leading up to their next home purchase or refinance transaction.

How It All Came Together

Founded in the heart of Toronto’s innovation ecosystem in 2017, founders Nick Seelert and Saroop Bharwani came together after experiencing multiple pain points with their banks during the home-buying process. They also have a background in consulting with mortgage providers, and started with an idea to create a winning outcome for borrowers by partnering with the financial institutions that provide services to them.

Providing Proactive Intelligence To Canadian Borrowers At Scale

Based in Toronto, Ontario, Senso currently oversees $1.3 trillion of mortgage debt, providing Canada’s largest financial institutions with proactive intelligence to engage borrowers. This has consistently proven to increase engagement, interest income growth, and borrower satisfaction.

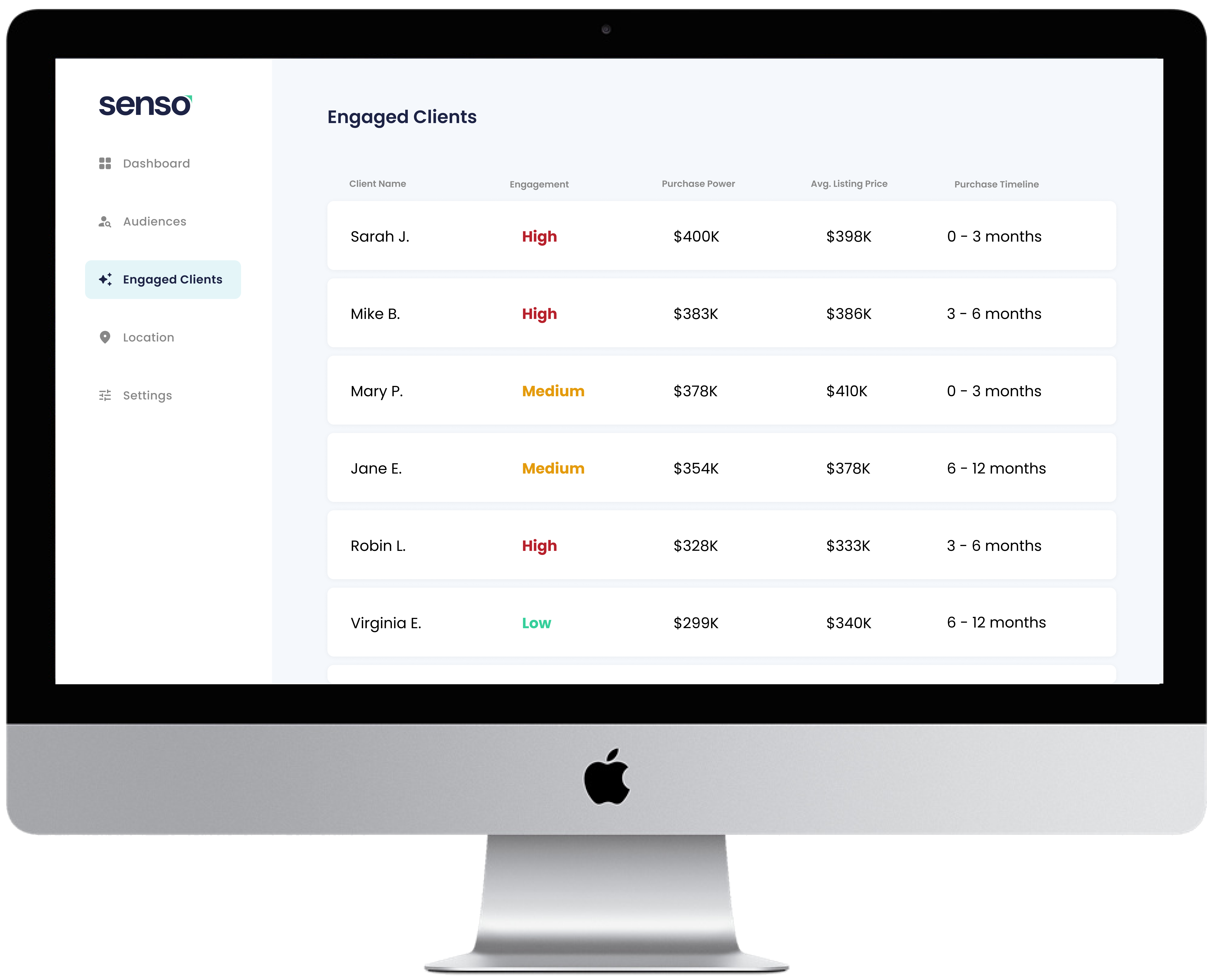

In collaboration with TransUnion, a global credit bureau that makes trust possible in the modern economy, Senso offers financial institutions a predictive score that identifies borrower segments that are likely to be active for their next home purchase or refinance within the next six months. This overcomes a massive problem for financial institutions that experience call center capacity constraints and an inability to serve their clients effectively.

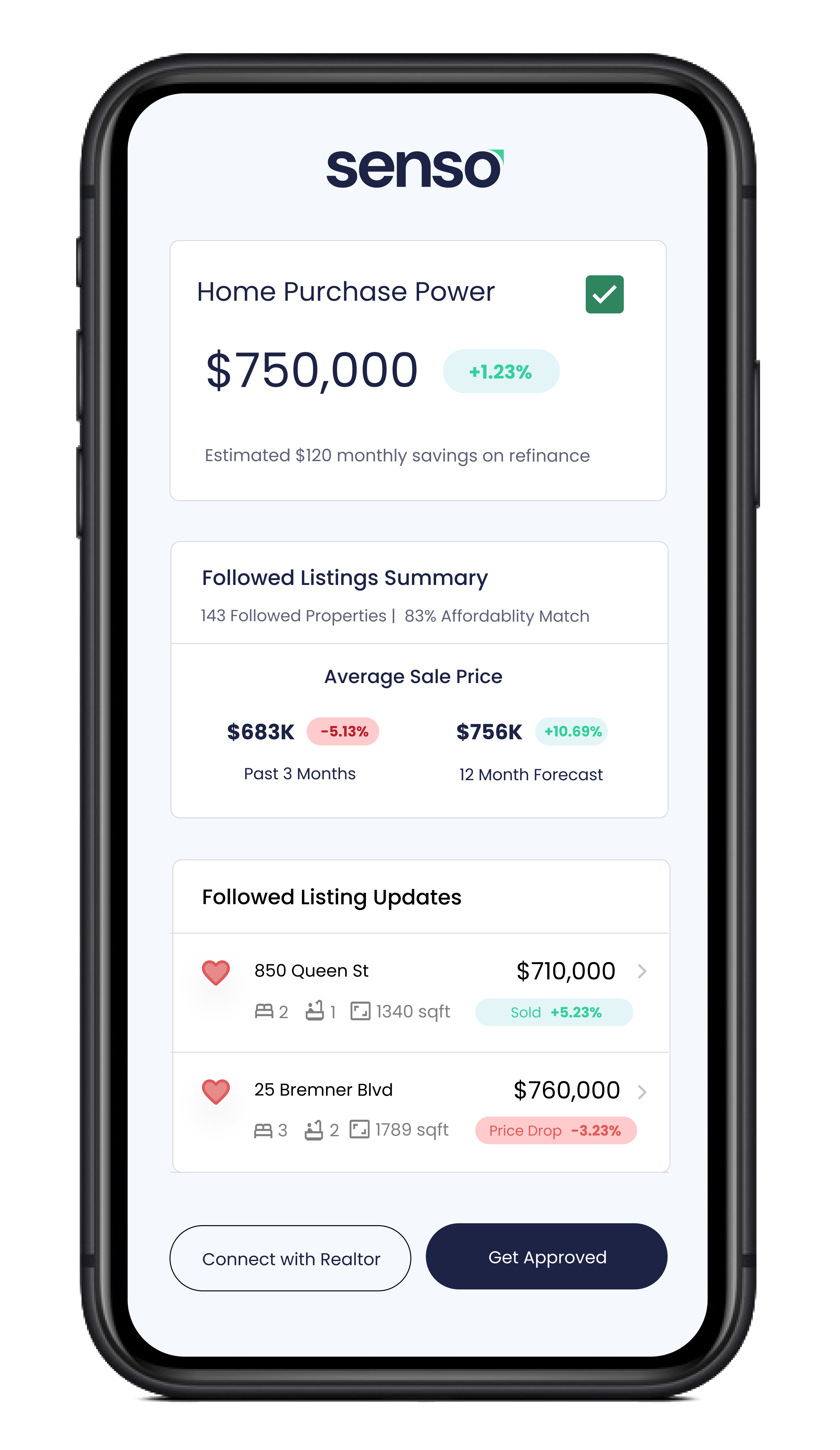

Borrowers are provided with rich experiences at the right time and on the right channel via bank partners to assist in guided, data-driven decisions leading up to the biggest transaction of their lives. With Senso, mortgage providers have the ability to proactively pre-approve borrowers for their home purchase before competing originators, and surface up home listings within their affordability to unlock transparency and alignment between loan specialists and realtors.

Senso’s proven solution has increased mortgage close rates by greater than 5x, and interest income by greater than 10x by identifying high value borrowers to engage with at the right time.

Canadian Entrepreneurs Improving The American Dream

The global pandemic created a similar pain point for US mortgage providers. With eight out of 10 active borrowers switching to competing originators, Senso quickly responded with the solution they incubated in the heart of the Canadian innovation ecosystem.

Senso now provides US-based community banks and credit unions with insights that enable them to improve borrower engagement and lifetime value. Borrowers that interact with partner banks are provided with rich insights enabling them to make decisions on areas to search, properties to monitor, and when to place an offer.

Backed by leading venture capitalists and partnered with the most innovative financial institutions in North America, Senso is on a mission to democratize access to insights and decision-making capabilities that empower financial institutions to improve their relationships with borrowers at scale.