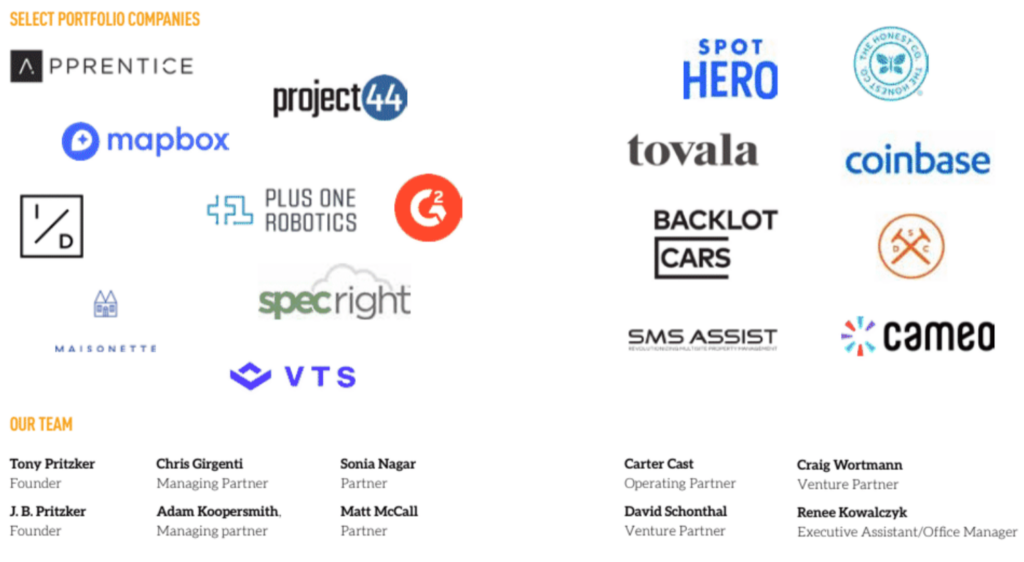

ABOUT PGVC

Pritzker Group, founded by Tony and J.B. Pritzker, has three principal investment teams: Venture Capital, which provides early-stage venture funding to technology companies throughout the United States; Private Capital, which acquires and operates leading North America based companies; and Asset Management, which partners with top-performing investment managers across global public markets.

Pritzker Group Venture Capital (PGVC) helps entrepreneurs build market-leading technology companies at the early stages of their growth. Since its founding in 1996, the firm has worked side-by-side with entrepreneurs at more than 250 companies, building partnerships based on trust and integrity. The firm has built a unique investment platform consisting of (i) investment professionals with more than 80 years of experience, including senior partners who have worked together for more than 15 years, (ii) an operating platform built by world-class operators, and (iii) relationships that span more than 50% of the F1000 Board room and C-Suite. The firm’s proprietary capital structure allows for tremendous flexibility, and its experienced team of investment professionals and entrepreneur advisors offer companies a vast network of strategic relationships and guidance.

HOW WE CAN HELP

YOUR FIRST CALL

Empathetic:

We know what you’re doing is really hard. We’re here for you. We listen and care.

Value-added:

We are knowledgeable about your industry and are responsive to your needs. We roll up our sleeves and help you solve problems.

FLEXIBLE LONG-TERM CAPITAL

No LP’s:

We’re an evergreen fund, beside you all the way. We have a long-term view on value maximization, with no artificial exit timelines.

CUSTOMER KNOWLEDGE

Experienced:

We have a knowledgeable, accessible team with 25+ years of success in the venture business.

Clout and reach:

We manage $8 billion in assets across three operating funds. We have strong ties to F1000 companies.

GEOGRAPHY

We are a national firm headquartered out of Chicago with strong ties to Los Angeles and New York. We are deeply rooted in these markets, having connections to local entrepreneurial talent, potential customers, and other VCs. We also have a wide array of resources to help you successfully scale your startup.

INVESTMENT PHILOSOPHY

INVESTMENT SECTORS

Vertical SaaS • Marketplaces • Consumer Internet

INVESTMENT STRATEGY

Our sweet spot is Series A although we will strategically invest in seed rounds. Our approach allows us to help shape and fuel a company’s growth throughout its lifecycle.

SEED STAGE

Our seed investment strategy enables us to support founders in our key focus areas and geographies earlier with the hope of being able to make larger investments in subsequent rounds. Our seed stage investment check size ranges from $500K to $2M per opportunity and we generally don’t lead.

SERIES A

Our Series A investment strategy is the core of our business – we look for compelling founding teams with businesses that have demonstrated product-market fit where we have an opportunity to lead a financing with a $4M-$6M check.

FOLLOW ON

Our follow-on investment strategy allows us to opportunistically invest in established companies seeking expansion capital to scale revenue.