Many people think having a “financial plan” means having a budget, a retirement savings account, and maybe a small cash reserve. But, those basic financials are only scratching the surface and exclude some key details like estate documents, saving strategies, or debt elimination plans. With that popular—and lacking—mindset, it’s perhaps unsurprising that 90% of people are missing at least one critical element of their financial plan.

You think that’s problematic? Let’s talk nextgen

A striking minority of millennials claim to have high financial literacy, while the majority of their peers—75 percent—fail to demonstrate basic financial knowledge. To top that, most millennials get their financial advice from Facebook and X (formerly known as Twitter)! Saddled with debt and lacking basic financial knowledge, Gen X and millennials are approaching their prime earning and savings years without sufficient preparation.

As the generation that grew up during the 2008 economic crisis, they’re wary of trusting financial institutions. So, how does the financial industry, which should be poised to help them, engage with this generation?

Cue Pocketnest

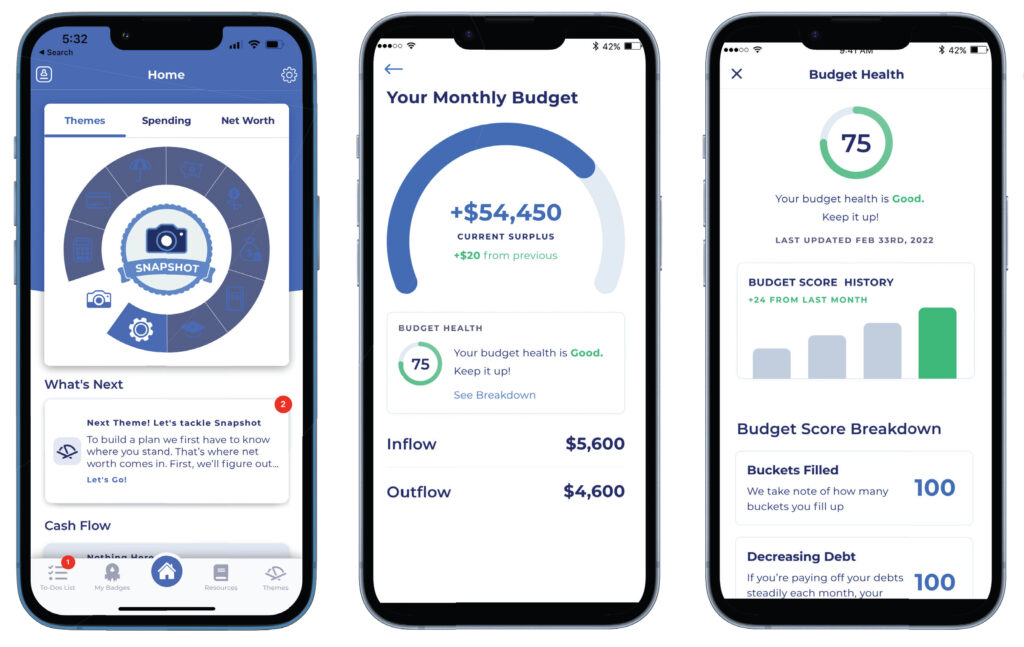

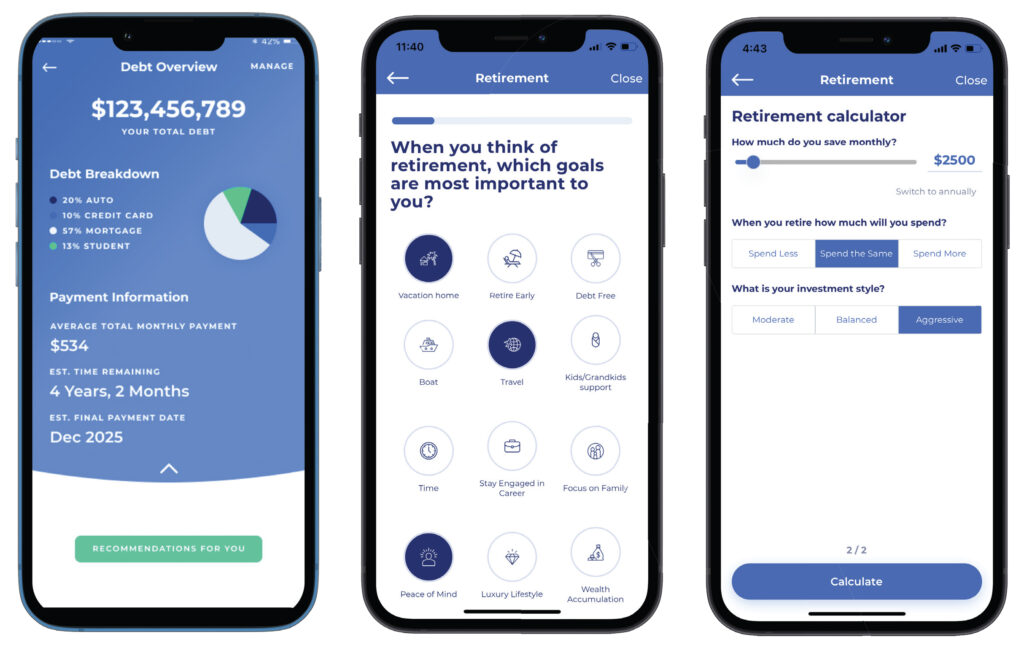

Pocketnest is a Google-accelerated financial wellness app that coaches users through 10 themes of financial wellness. Aimed at millennials and Gen X with jargon-free and approachable language, the platform walks users through their plans—covering everything from budgets, savings, and debt payoff planning, to taxes and estate planning—in just three minutes a week. Users can create—and stick to—a comprehensive financial plan with personalized tips and recommendations, all based on Certified Financial Planning curricula.

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!Using psychographic data and behavioral science, Pocketnest gets to know users—what makes them tick, motivates them, and gets them to complete financial tasks. Using AI, Pocketnest speaks to users in a way they’ll respond with soft nudges and personalized tasks. As Pocketnest coaches users through financial wellness, it gathers key insights about their financial needs. Users check off tasks while Pocketnest queues them up for better, more timely, and more relevant service from their financial institutions. This practice identifies cross-sell revenue opportunities for the financial institutions to which Pocketnest licenses its platform, like banks, credit unions, investment advisors, and 401k plan sponsors. Users love the enhanced experience, while institutions love the increased cross-sell opportunities and deeper client relationships.

And, not to mention, the entire app experience is white-labeled in the institution’s brand, helping make the institution more appealing to its communities.

Real value for users, their institutions

Pocketnest brings its users comprehensive financial wellness as it walks them through all 10 core themes of financial wellness and helps them to identify and fill gaps in their plans. The fintech also helps financial institutions reach more people, educate and qualify leads faster, and boost cross-sell opportunities. Pocketnest also licenses its software to employee wellness programs to help employers boost recruitment, productivity, and retention efforts while helping them offer employees better, more comprehensive employee benefits.

Launched in 2019, Pocketnest is recognized as one of the world’s most innovative startups and featured in Forbes and Fast Company’s Innovation by Design Awards.