But Newzoo wasn’t its founder’s (Peter Warman and Thijs Hagoort) first venture into the world of business. Far from it. After becoming friends playing basketball in high school, the industrious duo sold custom-designed t-shirts. Those early days taught them a valuable lesson: custom production based on manuals does not scale very well. To build a high-growth business, you need a different approach. They soon flooded the basketball club with a line of fresh but standardized shirts.

Newzoo started out as a company that connected people in the games industry with people who, each for their own reason, had an interest in this thriving business. But while talking to big consumer brands, investors, and game companies, Peter and Thijs quickly noticed something curious: there was little to no actionable market data on games. They set out to solve this issue first. Long story short, Newzoo officially started researching, modeling, and reporting on the games market in 2008.

The first edition of the iPhone also launched in the summer of 2007. This impacted Newzoo’s success, as this disruptive device changed the way the world thought about the digital landscape and the commercial significance of mobile gaming. Unlike market intelligence companies that were estimating boxed product revenues at the time, Thijs and Peter envisaged a bright future for mobile gaming and tracked this emerging space from day one.

Since then, the pace of change has been sky-high, as have Newzoo’s growth and desire to be ahead of the curve. The company focused completely on market intelligence and analytics, anticipating major shifts in technology and consumer behavior with an impact across many industries. This, of course, included esports.

Modelling the Esports Market

Newzoo first began talking about esports in a free report it released in 2013 called Power to the People. Following this, the team began to extensively track and model the esports market from both an industry and a consumer perspective. In January 2015, it released the landmark Global Growth of eSports: Trends, Revenues and Audience Towards 2017, becoming the first market research company to size and forecast the esports market. The report provided a much-needed overview of the esports economy and a realistic estimate of its future potential in terms of viewers, participants, and revenue streams. Since then, Newzoo has released six more annual global reports and has become the world’s go-to destination for esports data and insights. In 2021, the company expanded its report to recognize the significant role that live streaming plays in the gaming and esports ecosystems.

Newzoo’s revenue forecasts are widely quoted in the industry. These are based on its predictive eSports market model, incorporating data from many sources: macroeconomic and census data, primary consumer research, data provided by its industry data partners, public event data for viewership and attendees, media reports, and third-party research. These include revenue actuals from leading teams and companies in the industry. In August 2021, this included 26 partners across the globe, located in North America, Europe, Australia, China, South Korea, and Latin America.

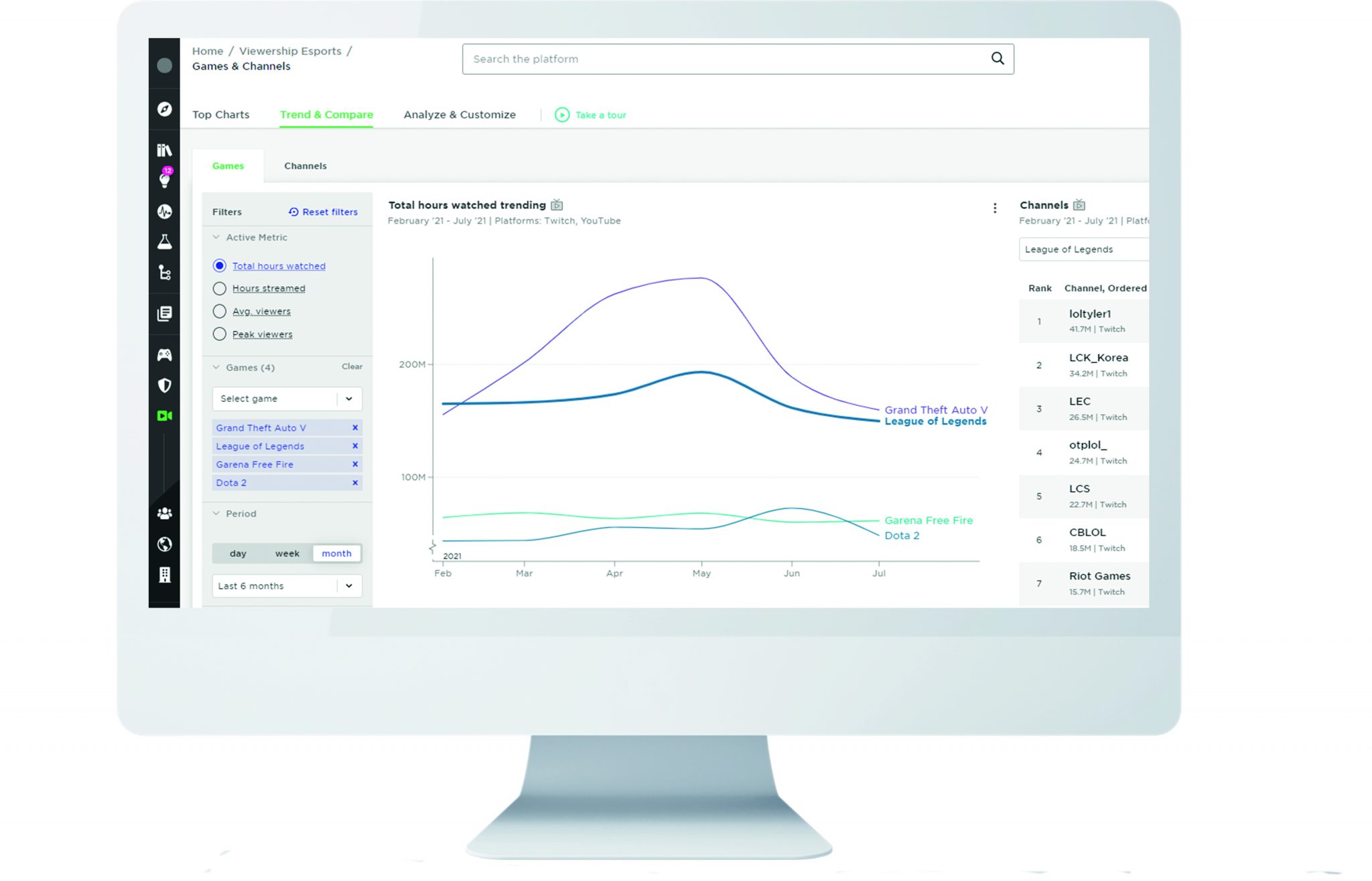

Aside from esports market sizing and forecasts, Newzoo’s subscribers also have access to in-depth game streaming data, esports team and competition viewership metrics, an esports sponsorships database, and consumer insights of esports fans. All accessible via the Newzoo Platform.