Digitisation and technological innovation are nothing new to the South African banking industry, but those banks that had made significant progress on their digital journeys before the Covid-19 pandemic, have been best placed to meet the fast-changing needs of their clients and, as is the case with Nedbank, gain efficiencies and grow market share in the process.

The progress that the bank made on its digital transformation journey equipped it with the technology infrastructure, world-class banking platforms and processes, and agility to move quickly when its clients most needed it to.

As a result, the bank has seen some impressive gains, not only in the digital migration of its existing clients, but also in its ability to attract and efficiently on-board new clients – despite remote working and social distancing challenges.

Over the past few years, Nedbank has invested into the development of a true omnichannel banking experience for our clients, including our ground-breaking Eclipse single client-view on-boarding and servicing system, various platform-based banking ecosystems, and our industry leading Open Banking (API) platform, and while we had no idea at the time we were developing these systems that they would be so absolutely vital to our customers in 2020, they have given us the ability to actually enhance our solutions and service delivery for the benefit of our clients.

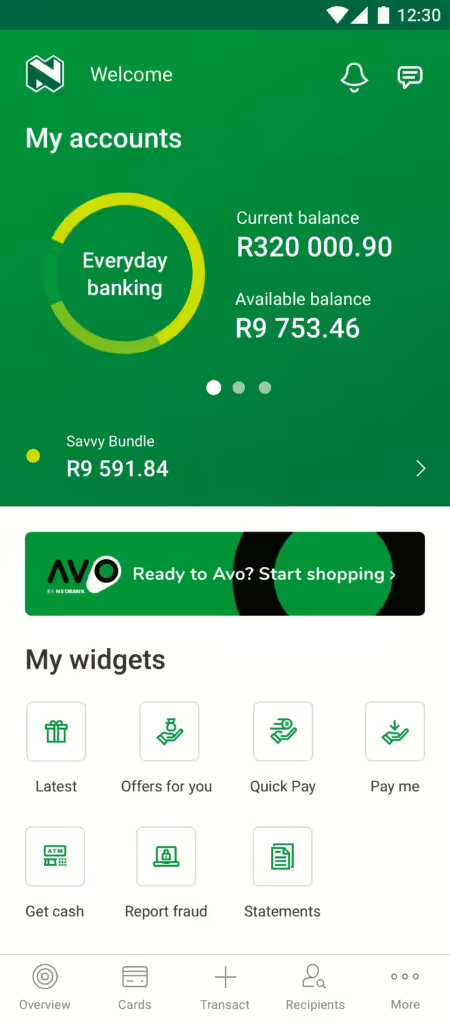

The benefits of Nedbank’s extensive investment into digitisation and the highly integrated, true omni-channel Nedbank system, makes accessing, transferring, managing and even investing funds quick, easy and secure.

The bank has long been committed to providing outstanding services and a range of innovative solutions that are, quite literally, life changing for South Africans.

Combined efforts across the group to lead in digital are paying dividends, with impressive achievements and exciting plans for the road ahead.

API Marketplace, Nedbank Retail and Business Banking Digital and Avo have all performed exceptionally well, delivering market-leading solutions and earning several awards in 2021. These include being named South Africa’s Best Digital Bank and Best Open Banking API Provider in the Global Banking and Finance Awards as well as the Efma-Accenture Bronze Award won by Avo for Reimagining the Customer Experience.

Avo by Nedbank – #DoLifeDifferently Over the past couple of years, South Africans have faced unprecedented challenges. From the beginning, Avo has been there to show people how to do life differently – and now, we are helping our Avo customers have an amazing 2022. Having recently surpassed 1 million customers and 20,000 merchants, Avo is securely and conveniently connecting South Africans to each other in the most meaningful ways every day.

The recent launch of Avo Auto introduces the latest, most innovative end-to-end car shopping platform on the South African market. Clients can browse and compare thousands of cars from dealers across South Africa and finance their dream cars, all without leaving the Avo Auto website.

To complete the e-Commerce circle, Avo has also launched a first of its kind B2B marketplace. The Avo team is currently deeply embedded in the design of Avo 3.0, a fresh new app design that will launch mid-2022 and take customers’ shopping experiences to new heights. Already, our clients can beat loadshedding, spoil the family with the yummiest of takeaways, restock the pantry and much more – all in one app.

API Marketplace In 2021, API Marketplace focused on delivery (new products, existing products, platform scalability and evolution), third-party enablement and operational improvement. Highlights included multiple releases on Personal Loans and improvements to Wallet APIs as well as Accounts APIs to cater for new third-party demand.

The developer experience was enriched across all products to allow easier integration and reduce time to market, and key security enhancements further protected the platform and our customers. New product demand has revolved around quantifying market opportunities for insurance, rapid payments, card servicing for third parties and the requirements of the Nedbank Africa Regions.

Leading in digital The digital journey gained significant traction in 2021, setting up 2022 for even greater success. Having digital innovation at the heart of the organisation led to a broad range of new services to clients.

Here is a brief snapshot of some of the capabilities clients can now enjoy:

• Financial wellness tools with credit score ratings, helpful tips for clients and enhanced MoneyTracker functionality tools allowing for spend categorisation and management.

• Joining the bank and taking up banking products via the digital platforms is now even easier, with continued enhancements and automation of processes.

• Buying journeys and offerings were improved, with a new array of unit trusts, additional choice of more than 230 airtime and data products, an enriched experience for claiming free basic electricity for qualifying clients, and an enhanced gaming and software product catalogue.

• The ability to get cash at an ATM by scanning a QR code (a first in South Africa) and withdraw cash using a digital voucher code at a wide network of retailers as well as the launch of Apple Pay.

• Enbi, our new chatbot, now answers more than 100 000 client queries a month.

The continued focus on innovation through 2021 has driven continued growth in core digital metrics, with digitally active clients increasing by 11.4% to 2.3 million, of which 1.6 million clients are now using the Nedbank Money app.

Driving factors behind the growth have been core capabilities to make clients’ lives easier and more convenient, enhanced security to counter cybercrime, improved on-boarding journeys, transactional capability, increased access to services through API Marketplace and our fast-growing beyond banking offerings in Avo.