Lendio is an online service that helps business owners find the working capital they need to grow their business through the company’s network of over 75 lenders. This is done via a single 15-minute (or less) application.

Even early on in his youth, Luis Salazar had his eye on small business, and recognized its importance in local communities. During his travels he saw glimpses of how difficult growing a business could be at every level worldwide. Since that time, Luis has been involved in lending, served in the military and government, and started a number of his own businesses.

Now, in his latest venture, Salazar utilizes his past experience in residential and commercial mortgage lending, entrepreneurship, and business tax auditing as well as a high-tech online marketplace to help alleviate the financial hurdles of North Florida’s small business owners. Accessing working capital is consistently a top concern for small business owners, many of whom don’t realize there are options out there beyond their local banks.

Lendio North Florida aims to solve this problem with a high-tech, high-touch service that allows area business owners to access Lendio’s array of national lenders, with the optional benefit of the face-to-face service one might expect in a community bank. This has been particularly important as Florida’s business owners have faced the ongoing effects of the COVID-19 pandemic.

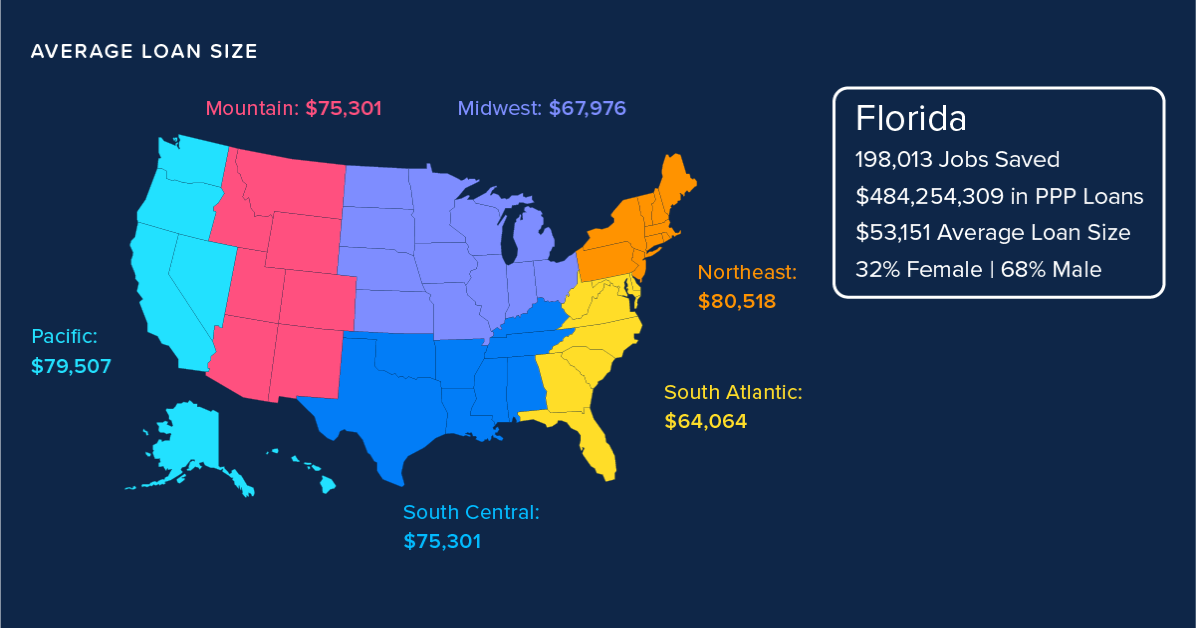

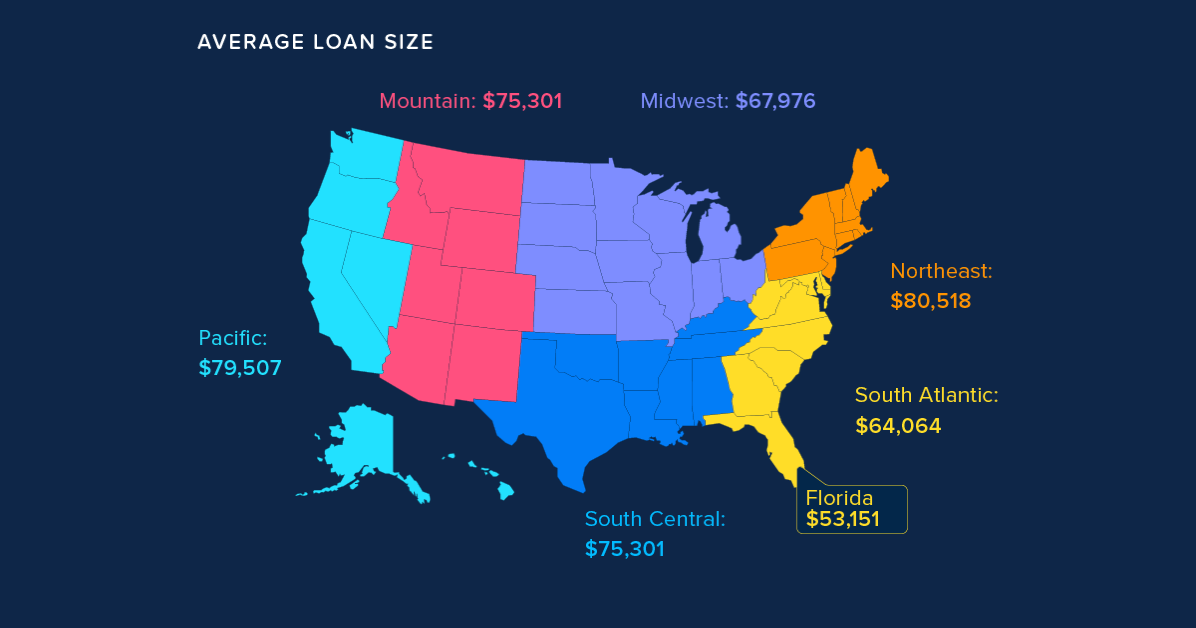

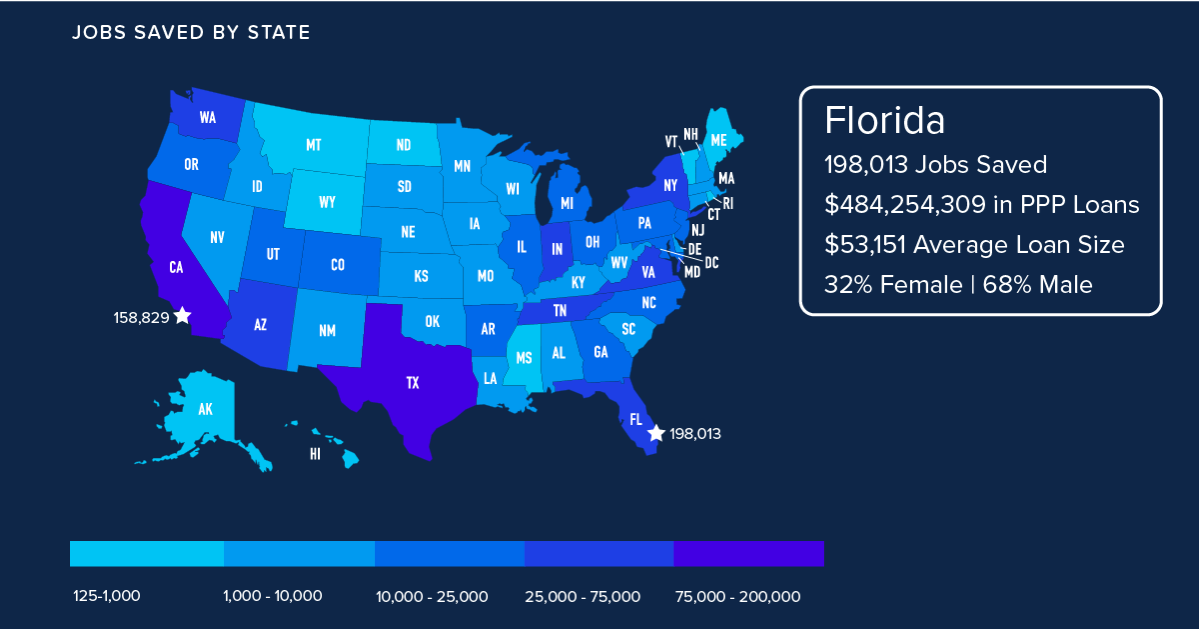

When the pandemic hit, business owners across the state were forced to shut their doors and found themselves in desperate need of a lifeline. This came in the form of Paycheck Protection Program (PPP) loans through a unique public-private partnership between the SBA and the nation’s financial institutions. Lendio quickly developed an online PPP application that allowed businesses to utilize its marketplace platform for PPP loans. At the time of this printing, Lendio has facilitated over $480 million in PPP loans to Florida business owners. Salazar has been instrumental in helping business owners in his community, particularly those without a prior SBA lender relationship, get access to these critical relief funds.

Since February 2018, Salazar has been working with local partners, local banks, and Lendio’s national network to assist business owners in acquiring funding for their growth. Carolyn and Michael Vescovi are two great examples of borrowers he has assisted. The Vescovis are both retired teachers from New Jersey who came to North Florida to fulfill a lifelong dream of opening a bagel shop with their son Luke, who is attending UF. They began making bagels in their home kitchen, but quickly outgrew the space and needed startup capital to secure a commercial space. With the help of Lendio’s innovative solutions, the two were able to secure $51,000 in revolving lines of credit.

Jorge Villalobos from The Best Restoration is another great example of how Lendio can help well established businesses grow and increase their bottom line, all in a matter of days. With Luis Salazar’s loan product expertise, he was able to quickly identify the root of some cash-flow challenges Jorge was experiencing. Luis quickly proposed a better solution that would consolidate some high interest loans, give Jorge additional working capital, and add an additional $40,000+ in savings back to Jorge’s bottom line. With Lendio’s high speed service, Luis was able to get Jorge approved for $100,000 and funded within 5 days.

As an immigrant and veteran, Salazar was welcomed to the Gainesville community with open arms and now tries to give back. He is highly supportive of, and supported by local community business groups such as the Greater Gainesville Chamber, Latin American Business Alliance, SCORE and others.