FinConecta provides the technology infrastructure necessary to implement open banking. Through one single integration, FinConecta can easily connect Financial Institutions’ core banking systems with third-party FinTech providers worldwide.

The platform that tests and integrates tech solutions 10x faster, accelerating open banking.

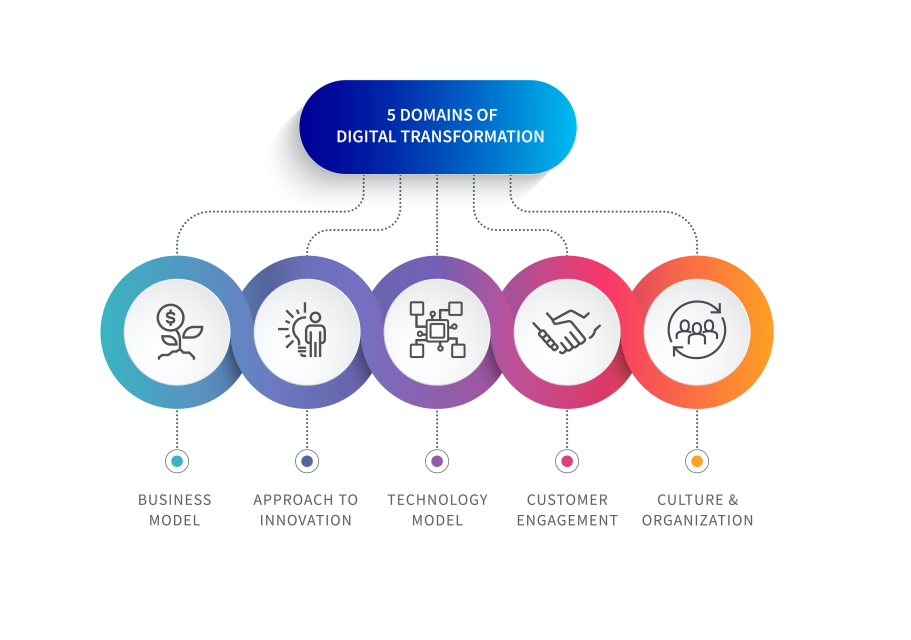

The digital era brings new disruptive technologies, innovative business models and new players that are rapidly modernizing the financial industry. Financial Institutions (FIs) are seeking new business models to get closer to customers, streamline their processes and respond to current market demands. Most FIs now understand the importance of moving towards an open architecture model to leverage new technologies and partner with third-party Fintech solutions. Open banking is revolutionizing how banks create value.

FInConecta’s platform, 4wrd, uses a switch engine that seamlessly accelerates open banking and innovation by facilitating the integration of multiple third-party solutions, bolstering digital bank initiatives and enabling the creation of marketplaces. With 4wrd, FIs can launch solutions 10 times faster, significantly reducing the time to market of new digital services.

Additionally, FinTechs can deploy services worldwide with just one integration, leveraging the power of the ecosystem. The platform is built on the foundation of the most modern and reliable technological infrastructure of APIs and ESB. It is a modular, flexible and scalable structure capable of supporting open banking models, where each component plays a specific role in the processing of digital services.

The 4 components of 4wrd introduce a wide range of solutions that include an API Gateway and management tool that facilitates the integration of third-party solutions, access to the only global Fintech marketplace with more than 200 tech solutions, a secure Sandbox environment for validating Fintech digital solutions using the financial institution’s core system’s test data, and the technological infrastructure to host all services securely in one place. FinConecta is a global company with the capital from the Inter-American Development Bank (IDB), The Venture City (private equity fund) and private investors.

FIs wishing to embrace the digital world need to partner with FinTech companies. Finding, selecting, and integrating FinTech services is the weakest link in this equation.