According to the Nilson Report, global losses from card fraud alone are expected to total $397.4 billion over the next 10 years, with $165.1 billion of those losses happening in the U.S.1

“We are dedicated to technology for good – and we know that our AI native technology makes a difference to real people’s lives.” — Dave Excell, Founder

The number of fake check scams reported to the FTC has steadily increased, and so have the dollars lost. In its most recent Data Spotlight, Don’t bank on a “cleared” check, the FTC reports that consumers lost more than $28 million to fake check scams in 2019 alone. The median loss reported was $1,988. That’s more than six times the median loss on all frauds tracked by the FTC.2

Featurespace is a world-leading enterprise technology provider that aims to prevent fraud and financial crime and make the world a safer place to transact. Illicit financial activity has been directly linked to:

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!- Human Trafficking – 49.6 million people are trapped in a form of human trafficking.

- Scams – $5.8 billion was lost to consumer financial scams in 2021.

- Child Sexual Exploitation – 1.7 million children globally were victims of commercial sexual exploitation in 2021.

- Elder Exploitation – $1.7 billion was lost in financial scams in 2021, impacting older adults. (Source: The Knoble)

Featurespace protects people and organizations from the rising threats of fraud and financial crime. The inventors of Adaptive Behavioral Analytics (ABA), Featurespace optimizes the speed and accuracy of detection, boosts revenue by facilitating higher transaction volumes, and reduces declined genuine transactions by up to 70%. But most importantly, the technology helps stop increasingly savvy fraudsters from targeting financial institutions and payment processors – ultimately, protecting consumers.

Featurespace’s ARIC™ Risk Hub uses Artificial Intelligence (AI) to analyze the entire payment journey quickly and accurately predicting individual behavior in real time by understanding risk even as underlying behaviors change. With this self-learning technology, anomalies in customer behavior are rapidly understood, evaluated, and acted on to stop fraud and financial crime.

Founded in 2008 in the UK, Featurespace has grown to more than 400 employees across seven global locations, including Atlanta, Georgia. Over 70 direct customers and 200,000 institutions have put their trust in Featurespace’s technology, including HSBC, NatWest, TSYS, Worldpay, Contis, Danske Bank, Akbank, Edenred, and Permanent TSB.

Adaptive, predictive, scalable, and secure. In today’s digital world, criminals exploit individual vulnerabilities and weaknesses in the global financial infrastructure, resulting in significant personal and institutional losses.

Real-time payments (RTP) are reaching momentum in implementation across the United States financial system because of their obvious advantage – speed. This benefit extends across the entire financial ecosystem – from consumers to merchants and financial institutions. It improves cash flow, increases process efficiencies, and lowers operating costs. However, real-time payments are also the perfect opportunity for criminals to commit real-time fraud and financial crime. In a real-time payment environment, criminals leverage account takeovers and authorized push payment scams to execute payment fraud. There are many attractive elements to this flavor of fraud for criminals. Still, chief among them is that the money is immediately accessible. Once they successfully transfer the victim’s funds, it’s game over – the money is snatched away in a flash or sent through a labyrinth of downstream transfers to other banks, often leaving the victim in utter despair.

In this fluid and fiercely competitive environment, only by truly understanding what genuine behavior looks like can banks and FIs identify and act on behavior that is out of character. Featurespace’s ARIC Risk Hub uses machine learning to model and predict individual behavior in real time to spot and stop fraud and financial crime as it occurs. Notoriously, fraud analytics are either accurate but slow-going or fast but not precise enough. Featurespace fits in that sweet spot for businesses to be accurate AND fast without sacrificing either.

“The fact that fraud is considered commonplace points to the real challenges in our sector. We need to build a future together where the fraudsters are two steps behind financial institutions, instead of two steps ahead.” — Martina King, CEO, Featurespace.

Only the adaptive survive

With an innovation team that is constantly ahead of others in the industry, Featurespace knows which innovations to focus on that will help customers keep ahead of fraudsters. Recently, Featurespace was named as one of the winners of the International PrivacyEnhancing Technologies (PETs) challenge, which was convened to drive innovation in PrivacyEnhancing Technologies that reinforce democratic values and announced at President Biden’s second Summit for Democracy.

In 2023, Featurespace launched Scam Detect, a solution that has demonstrated the exceptional ability to reduce scams by up to 33% on Day 1. Scam Detect offers the industry an out-of-the-box solution that provides an augmented score for the hardest to-detect scams (often those that have already gone through a bank’s first few lines of defense!). Scam Detect sniffs out the scammers in real time using Adaptive Behavioral Analytics with the best-in-class AI and machine learning models.

Generative AI: The Double-Edged Sword for Fraud Detection

At a time when there is growing concern about how fraudsters and bad actors will leverage innovative Generative AI technologies to evolve and target those who are most vulnerable to attack, the ‘good guys’ must always be quicker and more intelligent.

Featurespace’s most recent novel invention, TallierLTM™ is the world’s first Large Transaction Model, explicitly built for banks and trained on billions of transactions, which is already showing a 71% increase in fraud value detection. Launched in October 2023, the solution leverages the power of generative AI to combat fraud and financial crime. TallierLTM™ is built on Featurespace’s proprietary Automated Deep Behavioral Networks, developed in-house in 2021.

“The reaction has been phenomenal,” says Dave Excell, Featurespace’s Founder. “Major banks and tech providers are eager to partner with us and explore the possibilities that TallierLTM™ offers their organizations.” This enthusiasm stems from TallierLTM™’s ability to offer several key benefits:

- Catching more fraud: “TallierLTM™ enhances the fraud prediction performance of models by up to 71%,” explains Excell. This means detecting more fraud without unfairly impacting legitimate transactions.

- Real-time Decisions: The model supports real-time fraud detection, which is crucial in today’s fast-paced financial landscape.

- Pre-training: Featurespace has trained its proprietary algorithm on data from over 150 issuing banks to determine consumer spending patterns in milliseconds using billions of transactions.

Georgia-Grown AI that Protects Your Money

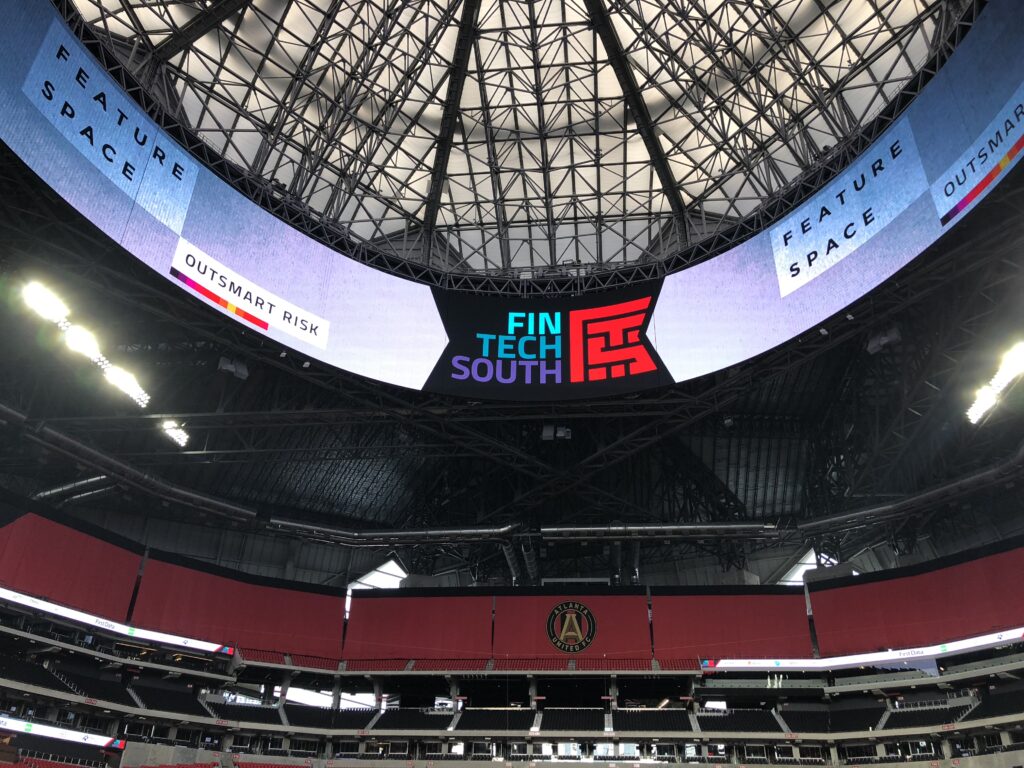

Georgia is not only a hub but also a global epicenter, for financial services. With 245 innovative FinTech companies processing an astounding 300 billion international payment transactions, Georgia is a force to be reckoned with. However, it is crucial that we protect these transactions against fraud and financial crime to ensure the continued success of this vibrant ecosystem. By doing so, we not only safeguard the financial well-being of countless individuals and businesses but also secure the future of a thriving industry that is vital to the economy.

Today’s world is fraught with fraud and financial crimes, and the tactics used by criminals evolve at an alarming speed. These networks operate with impunity, outside the boundaries of regulations that govern financial institutions and payment organizations. That’s where Featurespace comes in – it partners with the “good side” to help them stay ahead of the criminals. With cutting-edge technology and expertise, they can help identify and prevent fraudulent activities before they cause significant damage.

Featurespace is expanding its business in North America and has demonstrated its commitment to Georgia by hiring key talent for its midtown Atlanta offices. By strategically investing in its US workforce, Featurespace aims to enhance its world-leading capabilities and contribute to job creation in Georgia. This will have a positive impact on the local community and support the state’s economic development.