Before the COVID-19 pandemic, non-communicable diseases (NCDs) were already a priority on the global health agenda, responsible for 70% of deaths at a significant and escalating cost to the international economy. The pandemic has magnified the importance of addressing lifestyle-related risk: global research demonstrates that more than 50% of COVID-19 -related deaths are attributed to individuals with three or more comorbidities.

Business models that help make people healthier while simultaneously lowering the price of insurance, therefore have the potential to make a profound contribution to society by building resilience against both non-communicable and communicable diseases and helping individuals and healthcare systems weather severe shocks.

The insurance industry in fact has a unique role to play in building more resilient communities – a pressing need amidst the global crisis. Apart from government, insurance is the only entity that can tangibly monetise improved health outcomes. However, most insurance models fail to consider the change in insurance risk from pre-existing conditions to human behaviour.

There are four lifestyle choices – smoking, poor nutrition, physical inactivity, and alcohol consumption – that lead to 60% of mortality risk and 80% of morbidity risk. Yet traditional insurance models are based on the assumption of pre-existing risk, with underwriting and prices determined at the outset of the policy and premiums kept static throughout its lifetime. This model discounts the fact that underlying risk changes over the term of the contract as people make controllable lifestyle choices. As traditional models pool controllable risks, policy price and the amount of risk diverge, as policyholders become less healthy over time.

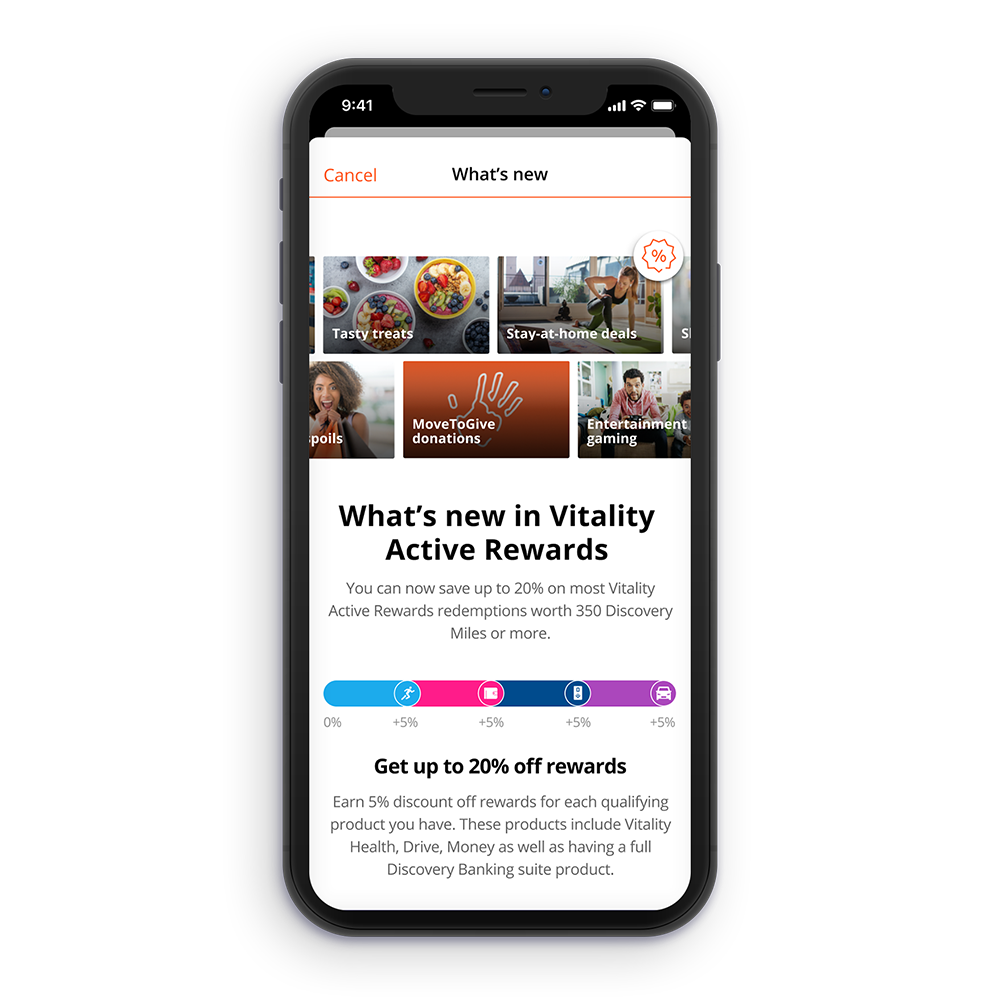

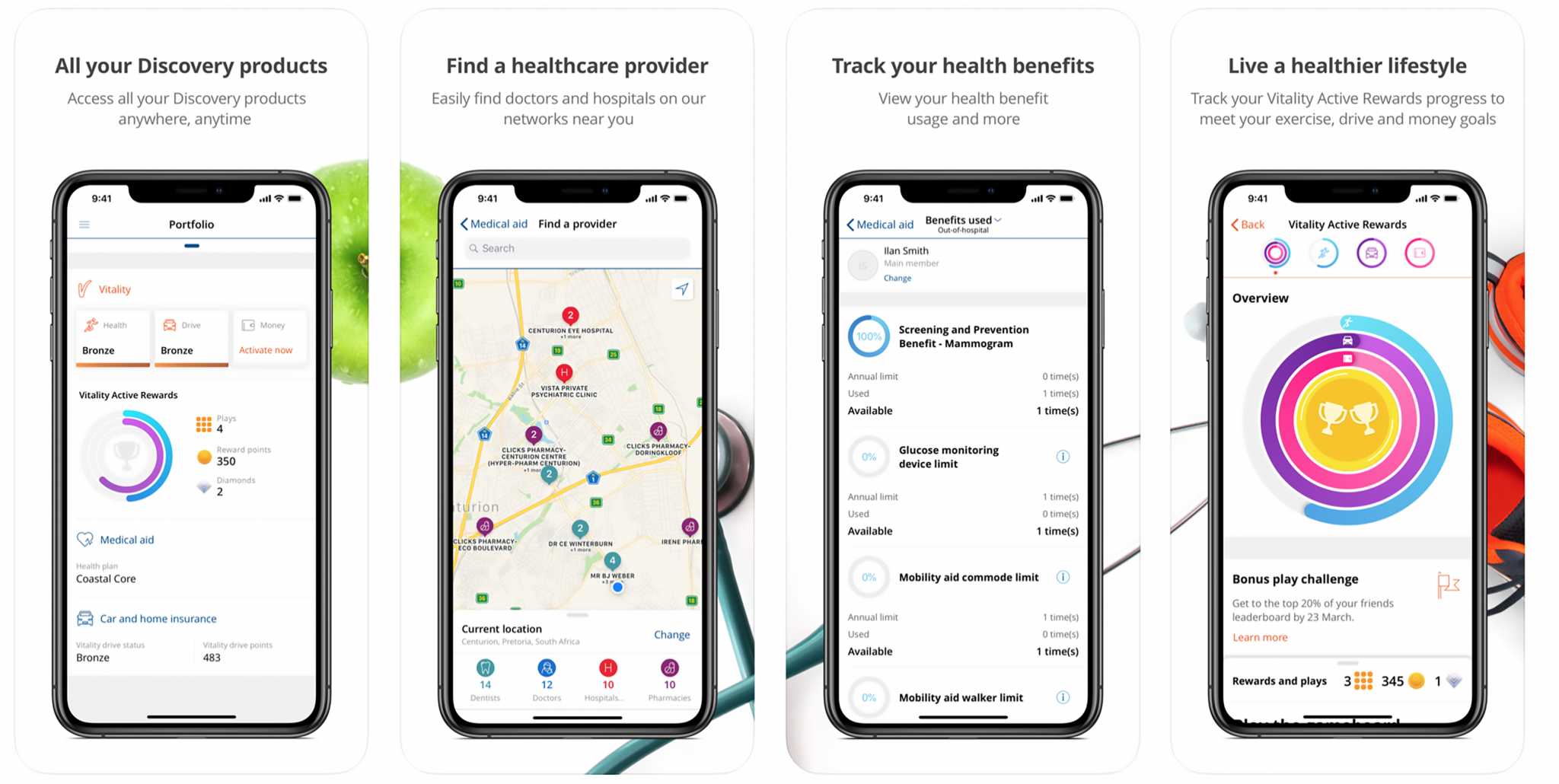

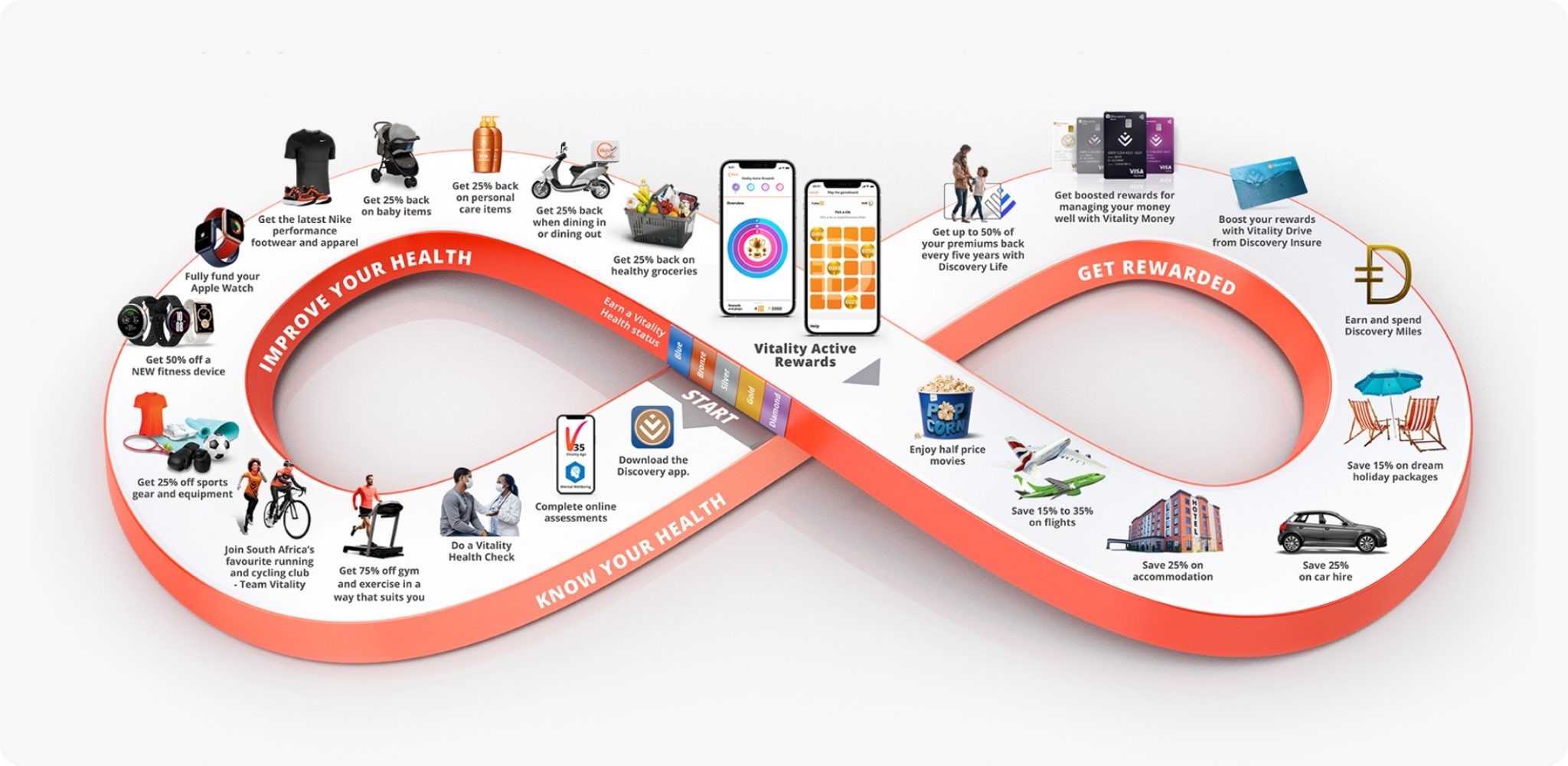

Discovery’s Vitality Shared-Value Insurance model is disruptive because it turns the insurance model on its head, becoming a driver of health and putting money back in people’s pockets. It focuses on behavioural components that decrease disease risk such as physical activity and healthy eating; incentivises healthier behaviours through regular engagement and personalised goals, and links this to the price of insurance. In the process value is created and shared between the insurer (better profits, lower claims), client (improved health and increased value) and society (healthier, more productive population).

South Africa has been the incubator and proving ground for this new approach to health and life insurance since Discovery was founded 30 years ago. Faced with a high and complex disease burden, few doctors, and community-rated insurance (where premiums are standardised regardless of risk), Discovery recognised the need to intervene on the demand side of healthcare by prioritising prevention; and was founded on a core purpose of making people healthier.

The Vitality Shared-Value Insurance model is the structural manifestation of this purpose and has since been scaled to over 35 markets around the world, through partnerships with leading insurers from Asia-Pacific (AIA, Ping An, Sumitomo) to Europe, (Generali, a.s.r.) to North and South America (John Hancock, Manulife, Prudential, Equivida, Saludsa) and the Middle East (Tawuniya). Given the pervasiveness of behaviour as a predictor of risk, the model has been expanded into new areas of business – including adjacent insurance lines such as motor insurance, and banking – and continues to be replicated into new geographies – with the recent addition of five new countries in Africa.

Now, with more than 20 million members worldwide, Vitality is in a unique position to inform and motivate its members through social, behavioural science and environmental strategies to educate and incentivise people to get healthier, drive better and manage their money well.