ABOUT BMO

For over 200 years, BMO has been helping individuals and families, small and medium-sized businesses, corporations and institutions that form the backbone of the communities we serve. We are a highly diversified financial services provider, with a deep sense of purpose and a clear strategy for driving strong customer and employee loyalty, leading efficiency, profitability and long-term growth.

OUR HISTORY OF INNOVATION

Embracing change and adopting new and better ways are fundamental to being a leader in this industry. We have had many innovative firsts, such as:

MECH: In 1969, BMO began building an online network of 1,100 branches with a real-time connection to a central computer. It was the largest banking terminal network in the world. The enhanced efficiency offered convenience for customers and allowed branch personnel to concentrate on customer service and expanded service capabilities.

mbanx: In 1996, BMO launched North America’s first full-service internet banking system. It was an entirely new virtual banking enterprise, designed to meet the needs and realities of time-pressed customers. Mobile banking: In 1999, BMO became the first bank in North America to offer financial services over a browser-enabled mobile device. Wireless banking allowed customers to use their cellphones to access their bank or brokerage accounts. They could also transfer funds, pay bills and get stock quotes.

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!Mobile banking: In 1999, BMO became the first bank in North America to offer financial services over a browser-enabled mobile device. Wireless banking allowed customers to use their cellphones to access their bank or brokerage accounts. They could also transfer funds, pay bills and get stock quotes.

WHAT INNOVATION LOOKS LIKE TODAY

We have come a long way and innovation continues to be critical to our success and contributes to fulfilling our purpose to Boldly Grow the Good in business and life; building on our commitments for a thriving economy, a sustainable future and a more inclusive society.

Our Digital First strategy is one way BMO is driving innovation for our colleagues and our customers. We are building our organization for speed, efficiency and scale. We will continue to make significant investments in our offerings and our infrastructure to enable BMO to provide customers with simple, personalized experiences that put them in control.

Our ongoing success in innovation will come from:

Our People: We have embedded innovation into our culture. It is weaved into the fabric of how we lead to instill a desire and passion to continually innovate, simplify work and eliminate complexity. We recruit to build a talented, diverse and inclusive workforce that will incorporate all voices, ideas and experiences to collaborate and innovate with pace.

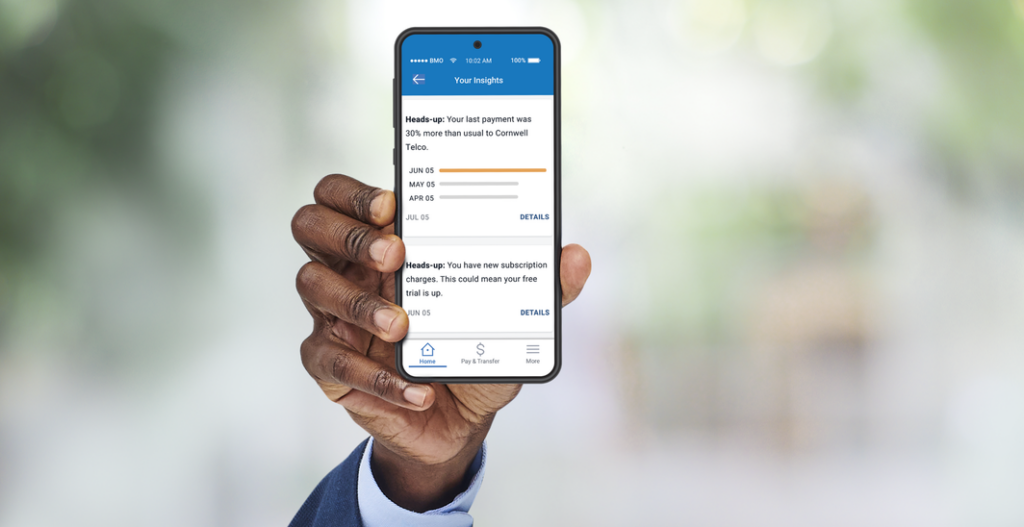

Technology: We are relentlessly driving digitization in our business processes so that our colleagues can spend more time with our clients. A recent innovative advancement that has helped our customers is BMO Cash Track Insight, an artificial intelligence-driven capability that provides customers a better way to manage upcoming expenses. This leading edge product received the Celent Model Bank Award, recognizing our solution as a best practice of technology use in an area critical to success in banking. It was also recognized by BAI for Customer Experience Innovation as part of their 2020 Global Innovation Awards.

Strong Partnerships: We recognize that as a large bank that has been in business for more than two centuries, innovation sometimes requires us to step outside our walls and leverage our partners to drive innovation. Working with 1871, the number one ranked Chicago-based global technology and entrepreneurship center, has allowed us to expand how we innovate for our customers and the bank. Through this partnership, we have not only mentored entrepreneurs who are bringing fresh and innovative ideas to how we can better serve our clients, we are working with businesses that are changing the very landscape of financial services. As part of this partnership, BMO also sponsors WMNfintech, a fintech industry program designed exclusively for women-led start-ups. Staying connected to these innovative entrepreneurs and building partnerships with organizations that bring fresh ideas to the table, has allowed us to connect to customers and support communities in meaningful ways that have resulted in record growth both in terms of customers and financial outcomes.

INNOVATING FOR OUR FUTURE

We recognize that our ability to thrive another 200 years, requires us to invest differently than banks have done in the past. To drive that work, we have made bold commitments to promote a thriving economy, a sustainable future and an inclusive society. BMO EMpower is our $5 billion commitment over five years to address key barriers faced by minority businesses, communities and families in the United States. Through lending, investment, giving and engagement in our local communities, we are tackling barriers to inclusion in the financial services industry to create more opportunity for recovery and success.