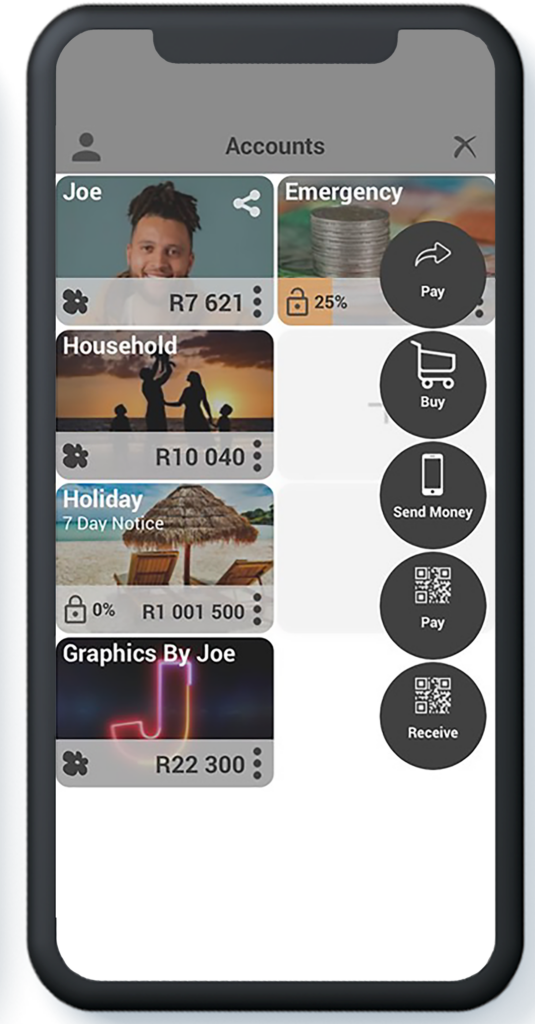

Bank Zero is a unique and powerful App-based bank with Zero fees and a patented secure card. It caters for both individuals and businesses.

Digital, social and financial connectedness is a reality and it’s also a very human trait. Bank Zero supports this directly in its innovative design. By friending their Bank Zero accounts to family / friends / children / staff / business partners / club and stokvel members (the list is endless!), customers can communicate financial issues, as well as share the process of saving and spending together – in a transparent and visual way.

The sign-up process for an individual takes less than five mins, including capturing of biometrics, loading of FICA documents and designing a personalised card.

Bank Zero enables businesses to load their owners, directors, and other role-players on one single screen through face tiles – and then drag those face tiles to different levels of an authorisation chain. Should mandates change, all it takes is a quick reshuffle of a single screen. No more branch visits required! And… ALL business owners have full transparency of all business actions and transactions – typically a source of fraud.

Just a Quick Note:

InnovationsOfTheWorld.com has partnered with Trade License Zone (TLZ) to support global innovators looking to expand internationally. Take advantage of the UAE’s Free Zones—enjoy streamlined setup, low corporate taxes, and a strategic gateway to the Middle East and beyond.

Get Your UAE Free Zone License Fast & Easy!

South Africa struggles with a low savings rate. Bank Zero gamifies savings by inspiring customers through unique savings goal pictures, progress bars and invites to other people who can help encourage them to save.

Banking fraud is increasing exponentially on a global level, and Bank Zero is intent on protecting its customers through a number of innovative features.

Personal App biometrics stop any unauthorised access to the customer’s Bank Zero App after a phishing attack.

Informative notifications keep Bank Zero customers up to speed on all banking actions (i.e. wider than just money movements). And Bank Zero proof of payments include a slew of valuable info, including the ability to display an invoice against the payment made, and the tracking/tracing of the money flow.

All debit orders are listed for a customer as urgent tasks, so that any rogue debit orders can be rejected immediately, and existing ones can be funded ahead of time.

The powerful Bank Zero card patent prevents the increasing occurrence of card skimming.

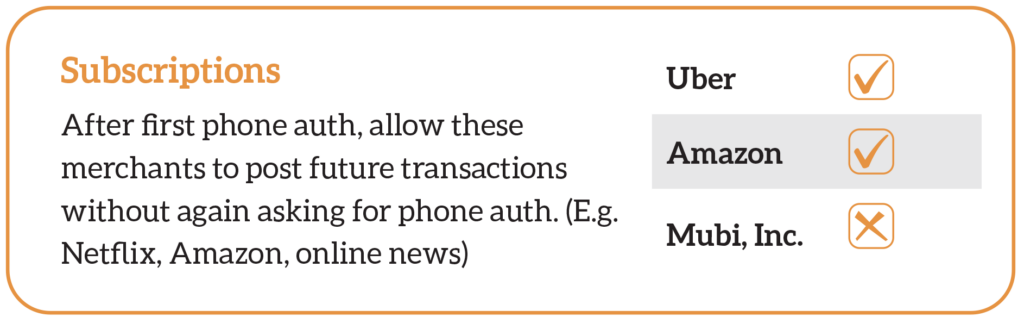

In addition, Bank Zero requires every single online card transaction – another fast-growing source of fraud – to be authorised. Recurring online card transactions often play the role of debit orders (e.g. online news sites or streaming services). Since customers are not always at their phones when such transactions are posted, Bank Zero has implemented a world first. Customers can indicate which subscriptions may be authorised automatically. This same functionality is also available for other merchants such as e-hailing services, etc.

Special ATM card settings control how a customer’s Bank Zero card can be used for cash withdrawals.

Bank Zero cards are not only super secure, but they are fun too – personalised with any picture of choice and any wording.

The same 16-digit card number can be retained when replacing a card, thereby removing the need to reset digital subscription services.

And at max 1% forex mark-up on all international card purchases, it is the ideal travel companion.

Bank Zero’s DNA is a nimble fintech start-up. But it also has its own banking licence which allows it to be a full settlement bank within the South African national payments system.

The team of Bank Zero co-founders and other executives have deep banking and technology skills, with extensive industry experience, providing a rare combination of refreshing fintech innovation and strong industry insights.

The offering was designed with a strong focus on providing security, transparency and control – to solve real banking problems which customers struggle with every day.

Instead of buying a banking package, Bank Zero was built from scratch, with its own technology stack (including the full core banking platform). This allowed for innovation, simplicity and regulatory requirements to be built in from the start, instead of bolted on afterwards at huge cost, complexity and risk.

Bank Zero wants to ensure a future of financial savvy customers. A major enabler of a person’s future success, is to start doing their own banking and saving from an early age. At Bank Zero any age can join, and will receive their own profile, own App setup and own card. In a world where kids do everything on smartphones, from TikTok to Snapchat, it is time that they engage with their banking too.

Bank Zero is the future of safe, simple and happy banking.