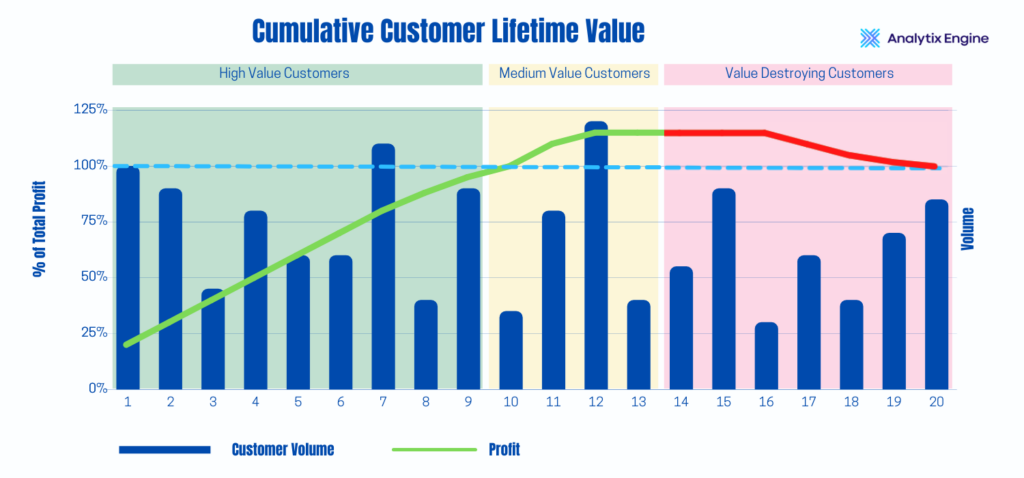

Most organisations have more data than they realise. The problem is usually the disconnect between business decision making and the curated data warehouse. In short, too much data but not enough insight. At Analytix Engine, we bring a highly experienced team of analytics professionals to help discover insights and operationalise better business decision making.

Customer Value Management Use Cases

We have been fortunate to assist a number of leading financial services organisations, including both banks and insurers, on their journey to next level customer value management.

Single View of Customer Lifetime Value

We have developed the single view of customer lifetime value for several of our clients. This includes details of demographic information combined with product holdings as well as both value and risk information. By adding forecasts of future product acquisition and utilisation, we can share insights not just of the customer value today but of the lifetime value that is expected to follow. For example, a graduate may provide a low fee income to a bank today, but as their careers develop, they provide material future fee income.

Cross & Up Sell

We have also developed two leads generation tools. These allow an organisation to understand their customers’ purchase behaviour to serve them better. One of our tools looks at products commonly held while the other looks at the sequence of purchasing behaviour, what are you likely to buy in the future given what you purchased in the past. The goal is not to sell to customers but rather to better match customers to products with sales as a natural result.

What Sets Us Apart

Our science-based approach to discovering relationships within your data makes us different. When faced with gigabytes of often imperfect data, a scientific basis of discovery can accelerate the path to decision-making. Using a combination of actuarial science, statistics, and machine learning, we can help you rapidly discover what data is relevant to the problem at hand. Then, how best to combine this data to allow for the inherent relationships to arrive at a single optimised recommendation on the way forward.

Typical questions that we help clients to answer include:

- Whom to lend to?

- Who will default on their debt?

- What product should we sell to this customer?

- How do we segment our customers?

- How do we better understand our profit margin?

- How do we optimise our portfolio value?

If you have data and a business question, talk to us about a better way forward. You may find our practical approach to data-based problem solving quite refreshing.