Amplify Capital is a Canadian-based investment fund that provides early-stage companies with long-term equity solutions and strategic support to develop their business to solve challenges affecting our future. Led by veteran private equity executive Kathryn Wortsman, Amplify Capital invests exclusively in impact ventures that demonstrate significant, measurable impact alongside market-rate returns. Amplify’s thesis is focused on North American companies addressing challenges in health, education, and climate that deliver both social and financial returns.

Amplify’s Fund I was launched in 2016 and incubated at the MaRS Discovery District, one of the leading urban innovation hubs in Canada. After the success of Fund I, we rebranded as Amplify Capital, and in 2022, closed an oversubscribed Fund II at $30.7M. Today, Amplify Capital is a leading Canadian impact fund managing over $37M across two funds with investments in 16 companies to date (8 in Fund I and 8 in Fund II) and one successful exit. The investment team brings experiences from private equity, engineering, technology, impact, and start-ups.

Impact Investing

Impact Investing requires a social or environmental return in addition to financial returns in line with the asset class. It is the explicit intent to generate positive impacts with financial returns and requires measuring and reporting these impacts alongside financial reports.

Impact Investing is experiencing unprecedented traction. Seventy-seven percent of millennials worldwide rank Environmental, Social, and Governance (ESG) as a top priority in investment opportunities. All major asset managers are adding ESG/Impact into their product offerings and demanding a social or environmental purpose for all assets.

Our goal is to make all investing impact investing. After analyzing the performance of nearly 11,000 mutual funds from 2004 to 2018, Morgan Stanley’s Institute for Sustainable Investing shows that there is no financial trade-off in the returns of sustainable funds compared to traditional funds. Additionally, these funds demonstrated a lower downside risk. It’s clear that by solving and measuring massive social and environmental challenges, impact-driven businesses have the potential to outperform traditional investments.

Our existing social and health infrastructure has significant gaps, and environmental responsibility is a top concern. The global economies are at a tipping point. They must become resilient to current and future environmental and social challenges. We get excited about solving large problems that matter to people and the planet. We lead with impact and empower entrepreneurs to generate long-term, compounding, economic and social returns.

Fund Goals

Our Fund Goals

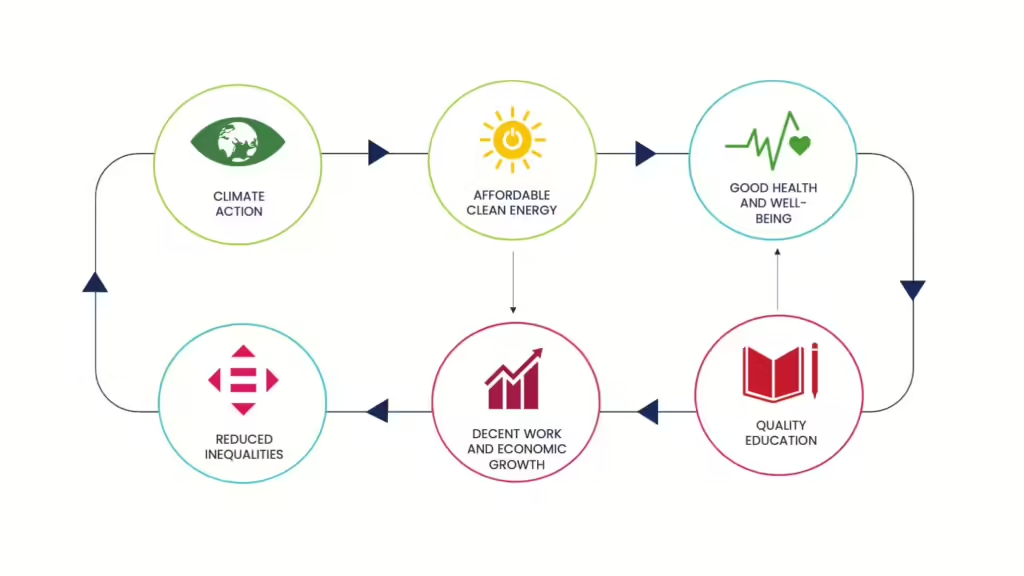

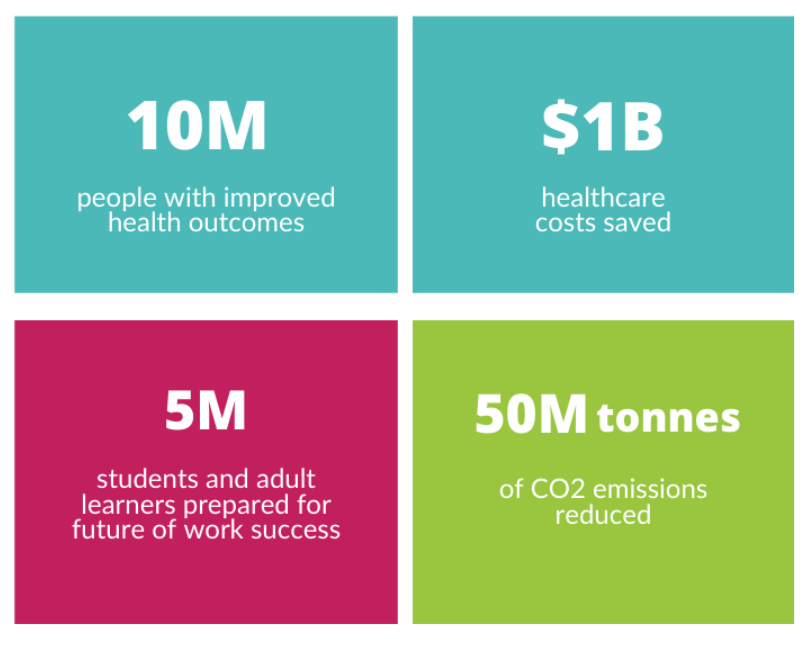

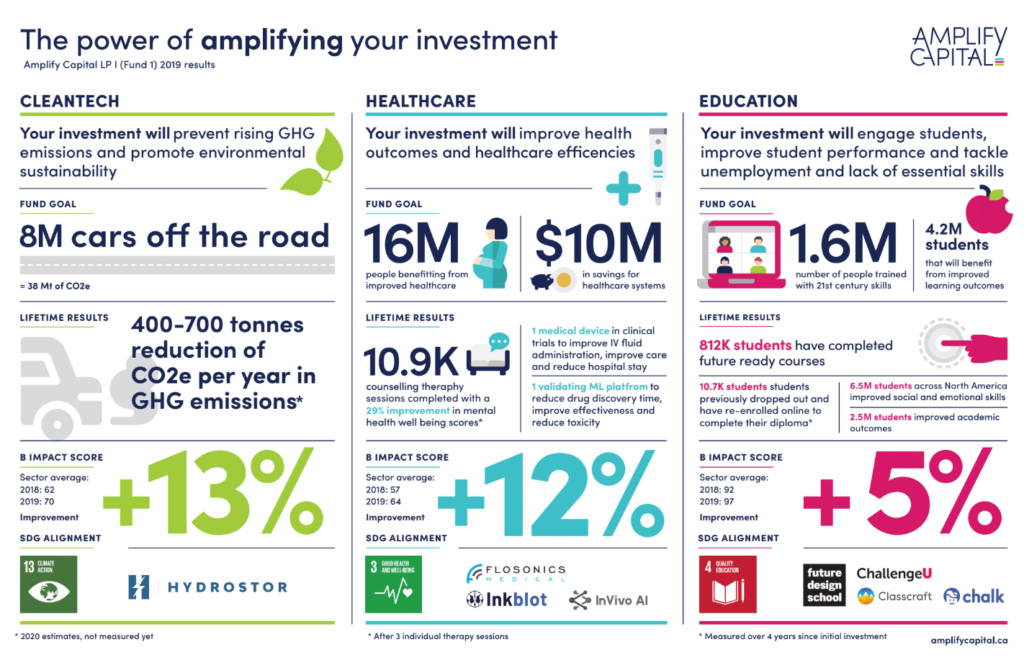

As an impact fund, all our investments contribute to one of our three fund goals in healthcare, education, and climate. Anchored in the UN Sustainable Development Goals, our themes reflect social and environmental megatrends that are transforming our planet.

- Improving Health Outcomes (SDG 3 Good Health & Well Being)

System inefficiencies and an aging population are increasing costs; we need to improve our health outcomes and delivery efficiency and provide access to affordable healthcare at scale to underserved communities. Amplify targets outcomes-focused investments that solve for lower wait times, reduced procedures, home and community care, and telehealth. To date, Amplify’s portfolio companies have improved the health outcomes of over 470,000 patients and saved ~$25.8 million in healthcare system costs. - Education for the Future of Work (SDG 4 Quality Education)

Students need to learn the critical problem-solving, creative, and collaborative skills required for 21st-century jobs. Promoting education for the future of work creates meaningful societal impacts such as improving social and emotional skills, higher engagement in both in-person and virtual classrooms, reducing bias, and increasing diversity in the workforce. To date, Amplify’s portfolio companies have improved the social and emotional skills of over 11.8 million students across North America. - Solving for Climate Change (SDG 13 Climate Action)

To meet global commitments to achieve net-zero emissions, innovations in climate tech will be required across all polluting industries. Amplify supports emerging technologies focused on accelerating the transition to a low-carbon economy by focusing on renewable resources and eliminating reliance on fossil fuels. We support innovations in long-duration energy storage, synthetic biology, and other innovations that support GHG emission reduction and a circular economy. To date, Amplify’s portfolio companies have reduced over 491 tonnes of CO2 and equivalents in greenhouse gas emissions.