InvestNext is on a mission to transform how investment firms raise and manage real estate investment capital. Founded in 2016 by Michael Gisi, Kevin Heras, and Matthew Attou, this Detroit startup was conceived to revolutionize how the industry operates. What they’ve created democratizes real estate investing and empowers investors to make a meaningful impact on the communities they invest in.

The Beginnings

In 2016, one of the company’s co-founders’ family friends, who runs a real estate investment trust, showed him the technology they used to manage their investment management business. It was a Windows 95 application—not retro—but actual Windows 95. Billions in real estate were managed through technology older than some of InvestNext’s staff.

This wasn’t just one firm’s problem. Across the industry, Michael, Kevin, and Matthew recognized a pattern: sophisticated real estate operations running on decades-old technology, clunky systems, and unnecessary complexity bottlenecking efficiency. That was the genesis for InvestNext.

“Since day one, we’ve known that tomorrow’s investors will not only have access to detailed performance metrics across their portfolios but also have the full picture of the positive impact they have made on the communities they have invested in,” shares Michael.

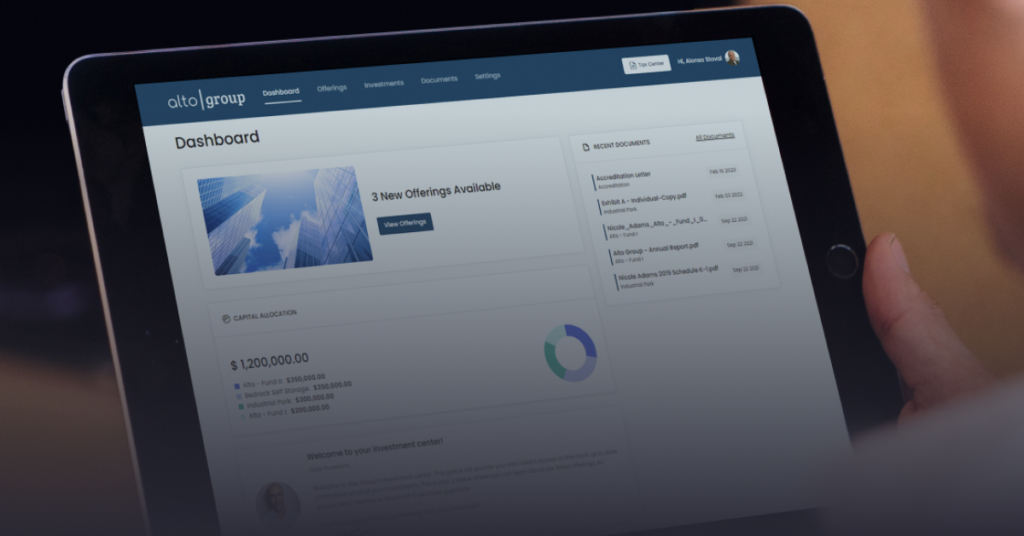

“With that in mind, we’ve built a software platform that enables investment firms to operate more effectively and provide greater transparency. Our close partnerships with commercial real estate syndicators and other investment firms around the globe are instrumental to this effort. Today, we are trusted by tens of thousands of investors, with billions of dollars managed on the platform.”

The City

In the 2010s, InvestNext’s three founders each gravitated to Detroit. Michael Gisi, who had grown up in North Dakota surrounded by the real estate industry, moved to study Computer Science at the University of Michigan. Kevin Heras, who had just graduated from Michigan Tech and had been part of the early team at Handshake, moved to continue his career in Detroit. Matthew Attou, who grew up in the Detroit area but moved away to pursue his career in technology, made a homecoming.

InvestNext started to take shape through late nights at the local coffee shop, trips to visit early customers, and a passion they each shared for innovation and building something new that would solve real-world problems.

InvestNext’s growth paralleled that of the much larger revitalization of Detroit around them. The city, previously a cautionary tale they’d grownup with, became a robust ecosystem for innovation and impact. Says Kevin: “We felt this was the perfect ground for starting a company such as ours. We were able to find early customers locally, join a community of builders and founders, and secure the funding that allowed us to accelerate InvestNext’s growth. On top of that, Detroit was a showcase for the impact that real estate can have on a city, both positive and negative.”

The Growth

InvestNext is undoubtedly a product-first platform. “The bulk of our energy and resources go into building things instead of talking about them,” enthuses Matthew. “It’s not that we aren’t proud of what we’ve built or don’t think it’s worth shouting about. But, We feel an immense responsibility to our clients to deliver on our commitments, including adding new value for clients on our platform post-contract signing.

”While InvestNext is proud to have been first-to-market with innovations now considered tablestakes – like inbound ACH funding – it knows it has to hold “now” in one hand and “future” in the other. The company’s vision for its platform’s future is limitless.

Since launching in 2016, this Detroit darling has grown 100% year over year, proving that its systems work as intended and were desperately needed by GPs and LPs alike. InvestNext boasts over 1,600 GPs on its platform, actively managing $15 billion in capital contributions from 75,000 active investors.

Today, it has processed well over a billion dollars in ACH payment distributions alone, and many more billions in actual distributions have been calculated and sent through its platform.

For InvestNext, its differentiators are:

- Balance recognized needs with emergingchallenges

- Invest in solutions, not promises

- Strive to be the best fit, not just the best

- Build for what’s coming, not just what is

The Future

The real estate technology space looks nothing like it did in 2016 when InvestNext started. Michael states: “Still, our job is to keep innovating and delivering impactful solutions for our customers, investors, and communities.

”Looking ahead, Investnext is building the infrastructure needed to navigate an increasingly complex regulatory landscape while making real estate investment more efficient and accessible. The challenges are evolving—from manual processes to fraud prevention—but its approach remains resolute: “Identify real problems. Build actual solutions. Measure what matters.”