In a world dominated by ever-evolving financial technology, Splitit emerged as a beacon of innovation, ushering in a new era of responsible shopping. While the ‘Buy Now, Pay Later’ (BNPL) industry surged forward, Splitit stood out as a trailblazer, transforming the landscape through their merchant-branded Installments-as-a-Service platform. Their mission was clear – to empower shoppers and enable merchants to revolutionize the way we pay.

It all began with a simple idea: to create a payment solution that makes people’s lives easier, seamless, and leverages their existing credit in a more efficient way. They wanted to redefine the concept of BNPL, building a new card-attached installment product that eliminates the cumbersome application processes, credit checks, and hidden fees that have become synonymous with the industry. For the millions of responsible credit card users, Splitit offers a smarter, more sensible choice.

Splitit is a breath of fresh air for shoppers who diligently pay off their credit card bills each month and don’t want to be burdened with additional loans or financial obligations. The platform allows them to maintain control over their installments while enjoying all the perks of using their existing credit cards, from rewards to transaction insurance and protection against fraud.

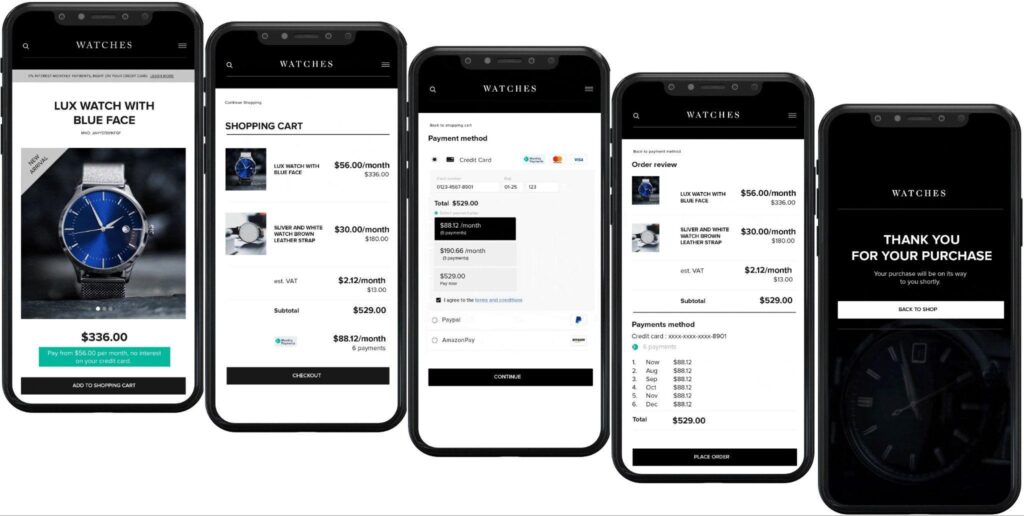

But Splitit didn’t stop there. Their white-label plugin gave merchants a powerful tool to nurture and retain their customer base, fostering brand loyalty and consistency. Splitit does not obtain the customer’s details for remarketing purposes. Customers who use Splitit will not be directed to an external website to register in order to finalize their payments. It is a win-win for both shoppers and retailers.

The heart of Splitit’s success lay in its ability to bring merchants 700MM+ pre-activated global shoppers that have an existing bank issued credit card in their wallet. Equally important is Splitit’s zero-friction checkout process, with no applications, no new loans, and no underwriting, the installment process is completely embedded within the merchant’s existing checkout flow. As shoppers are using the credit they already have available on their existing credit cards, Splitit boasts the highest approval rates in the industry. Their single global API and plugin’s to the top 10 eCommerce shopping carts, made implementation a breeze for merchants, who seamlessly integrate Splitit into their existing shopper journies. This approach also allows payment processors to maintain their valuable relationships with merchants, a critical aspect that is frequently underestimated in the world of installment payments.

Splitit’s genius was in leveraging the pre-existing and global credit card payment rails. They made installments an integral part of the checkout experience, allowing card networks, issuers, and acquirers to join the installments economy. This was a game-changer, ensuring that more issuers could be part of the installment payments process, without being overshadowed by fintechs that were trying to disintermediate them.

Splitit’s core mission is centered on enabling businesses to tap into a broad and financially stable consumer base pre-approved with existing credit, empowering companies to offer customers the flexibility to use their credit for their specific needs and tailor payment terms. With a global vision that extends beyond niche markets, Splitit aims to be the leading provider of card-based installment payment solutions for businesses and their clients, offering various payment options, including online, in-store, and over-the-phone installments. In the dynamic finance landscape, Splitit stands as a prime illustration of transformative benefits, reimagining the payments paradigm and reshaping the dynamics of responsible and convenient shopping for everyone involved.