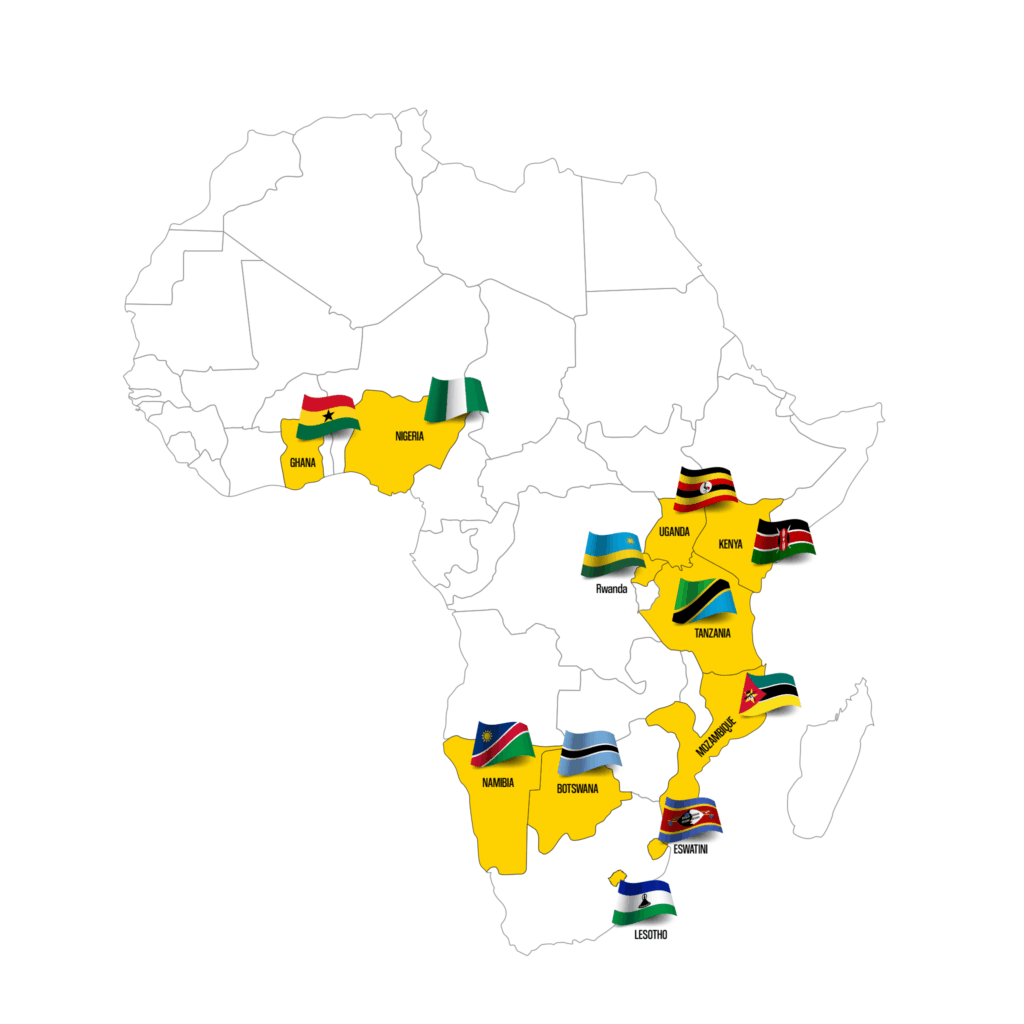

Since first opening its doors in Gaborone 24 years ago, inclusive finance leader, Letshego Holdings Limited, has extended its reach into 11 sub Saharan markets through organic growth and strategic acquisitions. The Group went public with its listing on the Botswana Stock Exchange in 2002.

As one of Botswana’s few home-grown multinationals, the financial institution has carved out a niche segment inbetween traditional banks and fintechs. This positioning has enabled Letshego to remain adaptive and flexible in adjusting to an increasingly competitive financial services sector, while maintaining business resilience through the pandemic and unpredictable market conditions inherent to an emerging markets business.

Letshego first established its regional brand as a valued public service partner and lender, initially supporting Government employees with simple, appropriate and affordable deduction at source loans. As the entity has expanded, Letshego has been steadfast in its purpose to ‘improve lives’ and to progress in diversifying its product offering by extending its reach to support individuals outside of the public sector, as well as Micro and Small Enterprises (MSEs) or small business owners.

In September 2020, Letshego announced its Strategic Transformation, a detailed and comprehensive 5 year plan structured to leverage the Group’s legacy strengths in pan-African experience and deduction at source lending. The objective is clear: to create a future-fit organisation that leverages digitalisation and technology to empower its people and maintain a competitive edge in a rapidly evolving financial services sector.

“Innovation is a term that is loosely used in many sectors, but when applied to bolster an existing successful and established commercial strategy, the outcomes are exponential. At Letshego, we have a hands-on understanding of regional market environments. We have taken the time to learn and understand the behavioural trends and needs of our customers, leading to a Transformation Strategy that selects the technology and digital enhancements that will allow us to unlock long term commercial and social value. We are amplifying customer levers that support our inclusive finance mandate, such as increasing access, affordability, product choice, and social impact. It is about solving for real needs, and for real people. People across Africa are at the heart of why we do what we do.”

– Group Chief Executive, Aupa Monyatsi –

Letshego’s 5 year plan is mapped out in what the Group refers to as its ‘6-2-5 execution roadmap’. The roadmap sets out the Group’s phased approach in investment, adaptation and implementation of its digital and technical enhancements, systems automation and product diversification, ultimately increasing customer experience, growth and longterm stakeholder value.

Letshego’s strategic areas of focus or ‘5 Conversations’ are: Digitalisation; Product Diversification; Geographic Rebalancing; Agile Execution Engine and Sustainable Stakeholder Value.

Aupa Monyatsi, Group Chief Executive of Letshego Holdings added, “Innovation is not one dimensional when applied to any business, but multi-dimensional in its potential and exponential value. For this reason, Letshego has sought to gain the merits of innovative thinking and application across all functions of our business – be it innovation in products, systems, customer channels, communication, people-first empowerment or reporting. We have even innovated the way we work together and collaborate, by adopting world-class Agile Enterprise methodologies to increase execution, operational efficiencies and project delivery.”

Innovation in platforms increases access and operational efficiencies

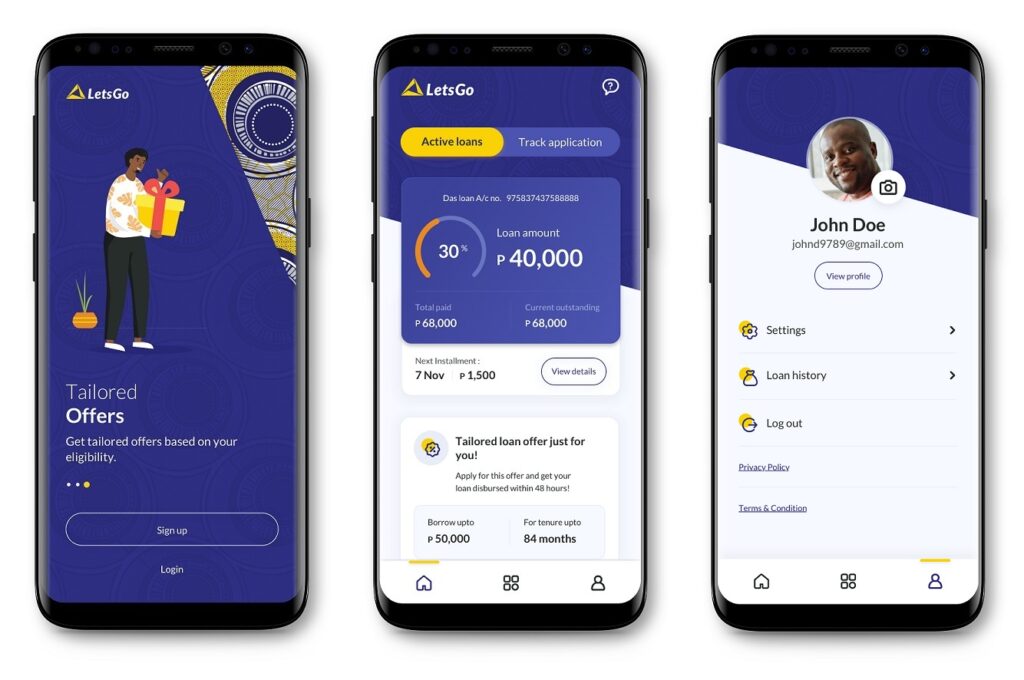

In 2021 Letshego concluded the launch of its digitised platform, the ‘LetsGo Digital Mall,’ providing omni-channel access to the Group’s growing suite of products and services. The Mall provides both financial and non-financial solutions, inclusive of lending, savings, insurance, payments and lifestyle. Omni-channel access includes USSD, WhatsApp, Web and Mobile App and is available on Google Play Store, Huawei App Gallery and iOS stores. Since its launch, Letshego’s ‘Digital Mall’ platform continues to be enhanced and evolved in capacity, function, capabilities, product choice and ease in user experience.

Monkgogi Mogorosi, Letshego Group Head of Digital Mall comments, “The pandemic served to fast-track the digitisation of our customer touch points to ensure our customers could still access our services and support without traveling to a branch. It helped our customers appreciate the power of using digital to access products and services. Artificial intelligence, robotics and data help us to deliver end-to-end zero touch processing for the majority of our financial services. The Mall can be considered a central catalyst or nucleus in the Group’s digitalisation strategy, where customer interfaces, systems, processes, tracking and operations will achieve seamless integration and functionality.”

“The vision for the LetsGo Digital Mall is a world-class platform providing a one-stop-shop for solutions to meet our customers’ personal and business needs. Letshego is leveraging partnerships with leading global fintechs to expand our product and service offerings and deliver sustainable value. The Mall is an easy to access, user-friendly and exciting virtual platform that is powered by robotics and data analytics to provide tailer-made financial and non-financial solutions to our regional communities. It has multiple entry points to cater for different customer segments and needs, with innovative offerings and partner services added on a continuous basis. The future is Digital….. LetsGo to the Mall!”

– Head of Digital Mall, Monkgogi Mogorosi –

Product diversification boosting customer choice and social impact

Letshego’s expansion in product choice includes the addition of standard financial services such as savings and payments, as well as inclusive concepts in product innovation such as ‘Crowd Saving’, ‘Affordable Housing’ and ‘Instant Loans’.

Lack of housing remains a national challenge for many countries across sub Saharan Africa, with more than half of Africa’s rural communities estimated to be living in informal structures often threatened by extreme weather conditions. Letshego’s commitment to improving lives by leveraging its offering and commercial capabilities led to its most recent flagship product launch: Affordable Housing.

In recognising the growing gap in accessing mortgages and housing finance, especially for those who are self-employed, Letshego’s affordable Housing serves to extend the reach of solutions that bring, security, and a healthy home environment. The housing solution offers customers a variety of options that include accessing finance for acquisition of land and a home, or accessing capital to renovate existing homes and residential structures.

“Letshego’s Affordable Housing goes a step further by empowering and recommending a network of local suppliers, artisans, builders, electricians and plumbers. The objective is to build a sustainable ecosystem that not only supports our customers, but also promotes local economic development through the inclusion of accredited suppliers and building contractors,” added Katundu.

Finally, Letshego’s Instant Loan is simply that, “instant access to cash.” With a few taps on their mobile phone, customers can have short-term cash loans deposited directly into their mobile wallets. Supported through effective partnerships with local mobile operators, Letshego customers can access smaller loans to bridge short-term cashflows, supporting daily or weekly cashflow needs, all while building their own formal credit record to support future access to capital. Traders and small business owners active in growing informal sectors often struggle to establish credit references and access capital easily; Letshego’s Instant Loans serve to bridge this gap.

“Our ‘Crowd Saving’ solution aligns with the new age concept of “crowd funding” and enables our customers to set their savings target in the LetsGo Digital Mall, and then invite family and friends to contribute or donate funds electronically. It’s a social tool that promotes networking while also encouraging the merits of saving, an important aspect of savvy financial management,”

– Group Chief Products Officer, Chipiliro Katundu –

Empowering a people-first culture to support digital age demands

Over 97% of Letshego’s employees have registered and participated on the Group’s Digital Learning platform. In partnership with Coursera, an external digital learning provider, Letshego has provided access to over 4,500 accredited course curricula from internationally recognised universities, colleges and educational institutions. The Group remains passionate about empowering its people, wherever they may be located, and building tomorrow’s people, today.

Recognising the increasing demand by companies to hire digital skills across the region, Letshego has also taken the initiative to help increase the availability of specialist skills within its markets by supporting digital and entrepreneurial skills development.

Botswana was the first market to launch the Digital Mastery Programme, where Letshego partnered with an external consultant to conduct a thorough search for local, digital and tech savvy candidates. Only 14 out of 1200 enthusiastic applicants managed to navigate and pass the arduous 4 stage interview process, and have now embarked on their 18 month development journey. The Digital Mastery Programme will see associates graduate through a series of interactive and practical on-the-job learning experiences across Letshego’s operations. This is in addition to opportunities to support digital innovation and entrepreneurial ecosystems through learning workshops.

“Practical and on-the-job learning is an important hallmark of the programme. We have further enhanced our Digital Mastery Programme by sponsoring basic living expenses for the final 14 Associates, allowing them to focus on the programme and not have to worry about a source of income over the 18 month period. With Letshego’s regional operations, our Digital Associates gain first-hand experience from Letshego’s operations as well as interaction with international partners, boosting future career prospects,” comments Kamogelo Chiusiwa, Group Chief People & Culture Officer.

Leadership and Executive Training are further enhanced through international programmes offered by recognised institutions, including the Gordon Institute of Business Science and McKinsey’s Black Academy, both offering global networks of professional students who gain world-class leadership and professional skills tuition.

“As we strive to become a digital-first organisation, our talent and skills base requires upskilling in digital and specialist skills to support the Group’s ongoing transformation. By providing easy access to internationally recognised curricula across a multitude of relevant topics, we can empower and train more of our people, wherever they may be located across our pan-Africa footprint.”

– Group Chief People & Culture Officer, Kamogelo Chiusiwa –

Innovations in governance and risk ensure holistic evolution in business transformation

Letshego’s risk management framework and tools have also benefited from technological innovation, with the automation and digitisation of its treasury and market risk management, credit evaluation and collections platforms.

Deployment of application scorecards and associated API integration with Credit Reference Bureaus provide Letshego with predictive credit decision capabilities that facilitate customers’ ability to access credit on a responsible basis, given the provision of an objective credit risk assessment. Integration with available Government infrastructure and other capabilities such as Optical Character Recognition (OCR) systems are also enabling Letshego to achieve straight-through processing options as well as increasing scalability of business processes, ultimately supporting improved service for Letshego customers. In markets where central credit bureaus may not cover self- employed entrepreneurs, these customers now have the opportunity to build their own credit records with Letshego’s digitised data and behavioural analysis platforms. Collections platforms now link with a customers’ behavioural score, thereby helping Letshego to deepen its understanding and relationship with customers.

“Digital technology is not only enabling Letshego to strengthen its risk mitigation processes and improve the quality of our portfolios, but also unlock value for our customers with additional rewards and better access to credit for those who manage their financial assets responsibly. This is truly empowering as it enables more individuals to participate in the formal economy, and gain access to more complex financial options to support income generation, and ultimately improve more lives.”

– Group Chief Risk Officer, Richard Ochieng –

Letshego Botswana, the Group’s commercial subsidiary, leverages regional research and innovation for the benefit of Botswana

100% of Letshego Botswana’s employees are Batswana, and responsible for leading and delivering Letshego’s solutions, support and products to customers across a mix of digital and physical channels.

Leading Letshego’s country and local investment strategy, Fergus Ferguson, Letshego’s CEO for Botswana, summarised the subsidiary’s focus on impact financing: “Our commitment to inclusive finance and achieving a marked impact in the lives of fellow Batswana informs and guides our structure, approach and delivery of financial solutions in Botswana. Recent product launches include Affordable Housing where customers can buy a house or renovate their existing home, irrespective of their location. Small business owners can access Purchase Order Financing to meet the cashflow demands that come with qualifying for larger tenders thereby increasing income potential. Individual customers can now access lifestyle solutions, like Wellbeing and ‘Mosako’ funeral cover.”

With the Group’s progress towards achieving its target operating model, and its increasing capacity in the acquisition, tracking and assimilation of data and statistics across its business, Letshego expects to continue to innovate its thinking and approach well beyond its 5 year plan.