You know how to lend. But, to whom do you lend, when you don’t have the right data? Too many business lenders are constrained by partial data and manual processes. And, speed is paramount.

Keren Moynihan, CEOBoss Insights empowers fintechs and lenders to respond faster, make underwriting decisions more quickly, and finally give business customers solutions tailored to their needs. Our platform connects fintechs, lenders, and banks with their business customers — and gives them the data they need to serve small-and-medium-sized business (SMB) clients. It’s a single connection to a 360-degree view on a business’s financial health.

As a lender, you enjoy a more holistic view of data for a real-time understanding of your clients and prospects, drawn from a rich, reliable set of sources. It complements your traditional decisioning and fosters a more nimble, responsive lending culture. As a bonus, it suggests products to your business customers based on their data.

Luke Moynihan, CTO

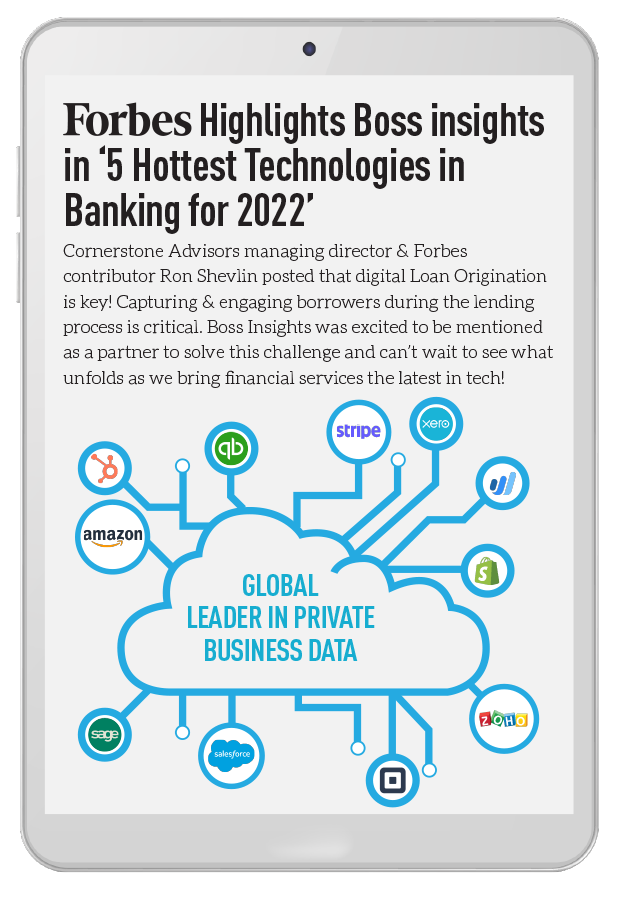

Boss Insights is an award-winning global leader in open banking. We deliver instant responses to SMBcentered lending, funding and payment applications.

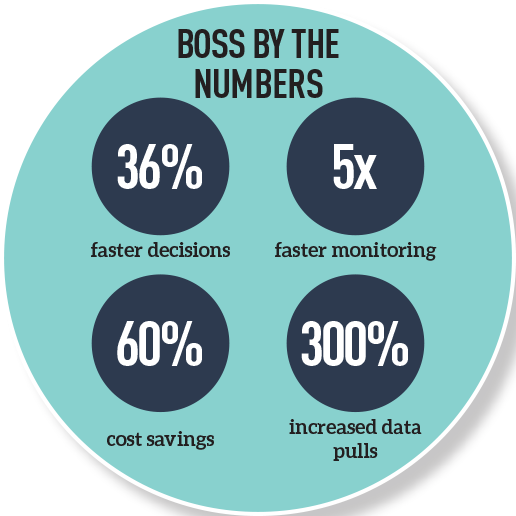

BEST IN BREED RESULTS

As the industry moves forward, discovering best in breed solutions to ensure your business customer is well served is key. It’s a combination of what FinTech offers and how well it integrates with other solutions.

We’ve shown 36% faster decisions, 5x faster monitoring and 60% cost savings.

• “Cutting edge tech” empowered us to offer a seamless experience for business owners” First Savings Bank automated business loan underwriting and loan approvals

• “A seamless solution to gather real-time information” Sound Credit Union automated business member lending

• ”Allows Carver to provide customers with the highest quality of service.” Carver Bank-supported diverse business owners’ with a business lending platform enabling financial data collection

• ”Responsive, solution-oriented and grew the platform as our requirements expanded” Seek Business Capital aggregated small business data and insights saving application and getting businesses faster access to funds

WHO WE WORK WITH

Fintechs

Private lenders

Payment companies

Financial institutions

VISION

Enable the world’s fintechs and financial institutions to build better financial services and unlock freedom for their business customers.