EUROPE’S FIRST INTEGRATED CREDIT INFRASTRUCTURE

Mifundo provides European banks with cross-border credit data that allows consumer credit histories to move between countries. This technology removes one of the last remaining barriers to financial mobility in the European Union: fragmented data locked within national borders. For millions of people who live, work, or study outside their country of origin, it enables continuity and access. For banks, it delivers credit information from other markets in a format that is secure, standardized, and ready for decision-making.

The platform is already in daily use at multiple banks across Europe. It connects to leading national credit bureaus and gives financial institutions access to verified consumer data from other European markets. This enables local banks to serve non-resident customers with the same level of confidence as domestic clients. Mifundo’s system translates financial data between jurisdictions, making it immediately usable in onboarding and credit decisions.

At Mifundo, the problem is personal. Many of its team members have lived and worked across Europe, including the Chief Product Officer, Keiu Kalaus, who spent 16 years in Spain before returning to Estonia. Despite her flawless Spanish credit history, she found herself invisible in her home country’s financial system: “In the banks’ systems, I simply didn’t exist,” she recalls.

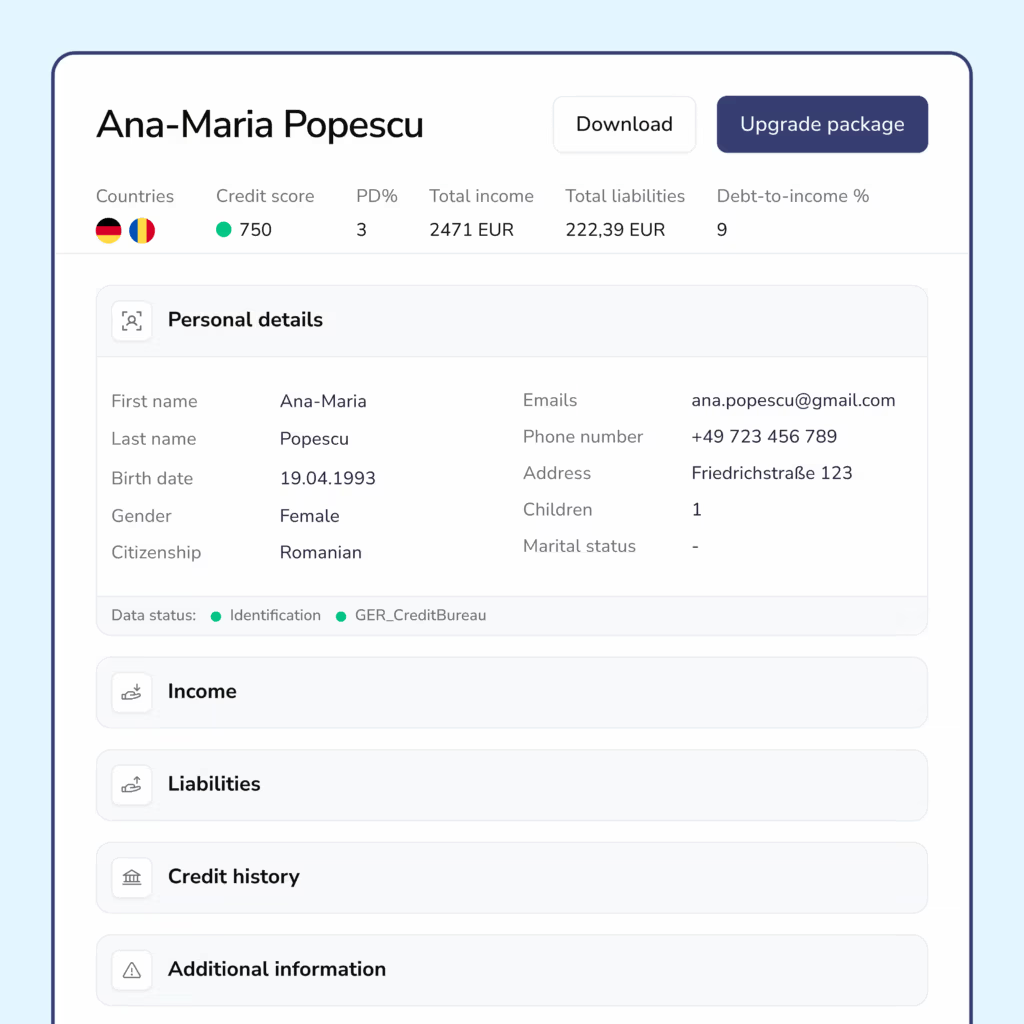

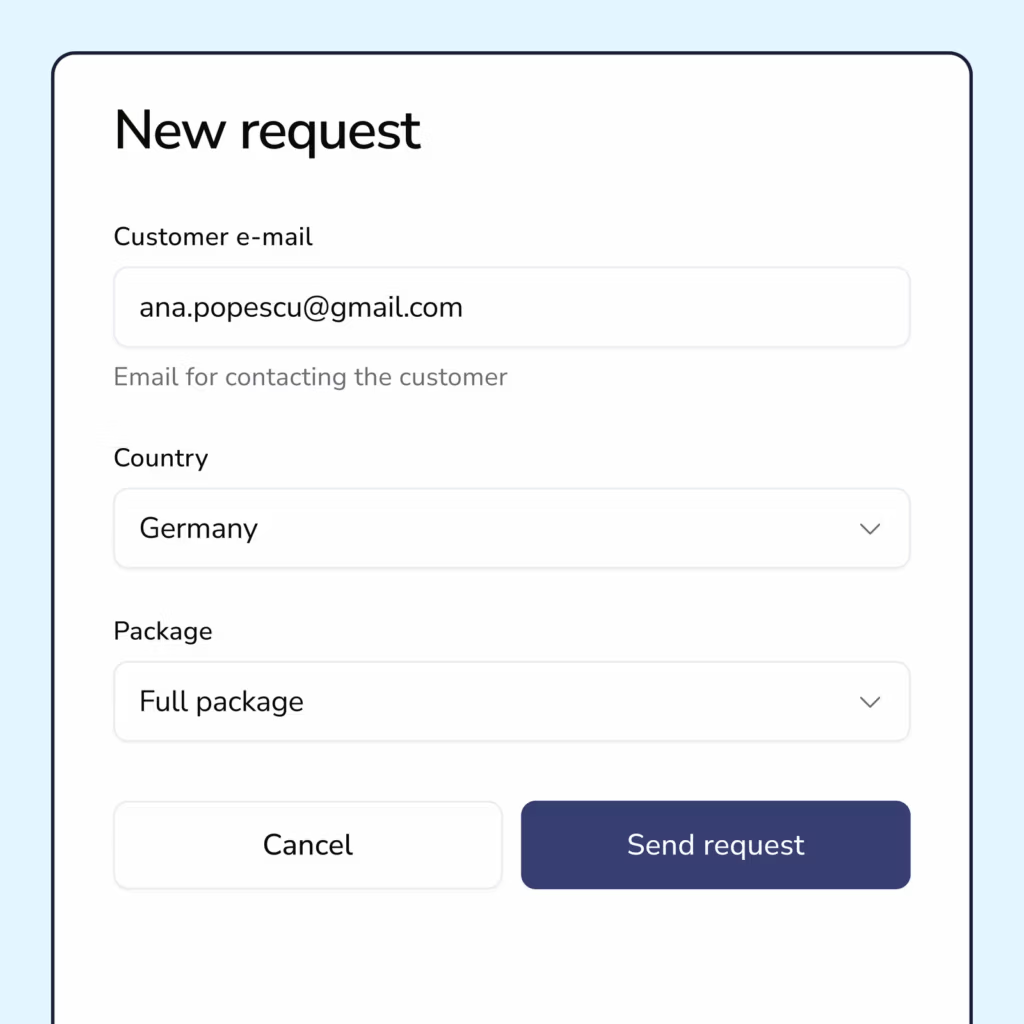

The product – Verified and Passportable Financial Identity – gives individuals the ability to carry their credit history wherever they go in Europe. A Swedish citizen applying for a loan in Portugal, for example, no longer needs to rely on self-declared income or wait for manual documentation. With consent, Mifundo retrieves the person’s data directly from their home country’s credit bureau, verifies it, standardizes it and delivers it to the receiving bank through an automated interface.

With access to verified credit data from other EU countries, banks no longer need to make assumptions about foreign applicants. Partner institutions report a sevenfold reduction in credit risk for non-local customers when decisions are based on standardized external data. They also see up to 15 percent growth in retail lending, as they can now approve clients who were previously considered unassessable.

Mifundo’s network now includes credit bureaus covering over 70 percent of the European population. The company is expanding its reach further, adding new countries and data sources through direct partnerships and bureau integrations. Each connection is fully compliant with both European and national regulations. Consumer consent is always required before data is accessed, and no information is stored longer than necessary for the requested transaction.

The platform is designed to serve a highly mobile population. It supports applications for personal loans, mortgages, car leasing, and credit cards. The same identity framework is also being extended to support small business credit, where cross-border movement of entrepreneurs has created similar data fragmentation challenges.

Founded in Estonia in 2018 by Kaido Saar, Mifundo was created to address a persistent gap in the European credit market. Although people are free to move between countries, their financial records often remain locked within national borders. Saar, who previously served as CEO of Bigbank Group and led its expansion into nine European countries, saw firsthand how commercial and regulatory inefficiencies limited cross-border lending. He began designing a platform that could solve this at scale. Despite the European Union’s single market framework, all 27 member states still operate their own credit systems with different legal, technical and procedural rules. This fragmentation makes it difficult for financial institutions to access or interpret consumer data across borders.

The result is a cross-border data infrastructure that integrates into existing banking systems. Mifundo does not require institutions to build new internal tools or alter their core processes. Its software works within current onboarding and risk assessment flows, retrieving foreign data where necessary and presenting it in the format the bank already uses. This seamless integration is one of the reasons for its rapid adoption.

ACCOLADES

In 2024, Mifundo became the first fintech company to receive direct equity investment from the European Innovation Council Accelerator. The award included a €2.5 million grant and a €6.3 million equity stake. This backing followed a series of industry recognitions across 2023, 2024 and 2025, including LendTech of the Year at the Europe Fintech Awards, Fintech Startup of the Year at the Banking Technology Awards, and selection by Mastercard Lighthouse as one of the most promising fintechs in Northern Europe. In 2025, Mifundo was also named Data Initiative of the Year at the Europe Fintech Awards and received the Cross-Border Fintech Award at the Baltic Fintech Awards.

MAKING CROSS-BORDER CREDIT DATA WORK FOR BANKS, CREDIT BUREAUS, AND CONSUMERS

Today, European banks are already using Mifundo’s solution to serve foreign customers. Foreign nationals are being approved for loans based on verified histories from other EU countries. Risk models are becoming more precise. Credit access is becoming fairer. Mifundo does not aim to replace national credit bureaus. It connects them. Its platform acts as a layer of translation and secure transport, allowing data from one country to be understood and accepted in another. The Verified and Passportable Financial Identity is built from bureau-sourced data. The bureau remains the authoritative source, and the bank continues to control its lending criteria. Mifundo provides the connection and the translation of the credit data.

Banks gain access to previously unreachable markets. Consumers get fairer treatment and faster approvals. Bureaus extend the utility of their data without losing control over it. And the EU moves closer to its goal of making the Single Market function more like a unified economy, especially in consumer finance.

Mifundo continues to engage with regulators and policy-makers across Europe, contributing insights into how data-sharing frameworks can evolve responsibly. It works with banks of various sizes, from digital-first institutions to traditional players, to support a broader move toward cross-border financial interoperability.

Mifundo’s product reflects the lived reality of modern Europe. People live in one country, work in another, and settle in a third. Their financial identity needs to reflect that movement. The Verified and Passportable Financial Identity allows it to do so – reliably, securely, and already in practice.

According to Saar, the system works because it aligns incentives. “We built something that is good for the consumer, useful for the bank, and supportive of the bureaus,” he says. “That’s the reason it scales. Everyone involved gets value from it.“