THE WORLD’S TRUSTED GATEWAY TO DIGITAL CURRENCIESAND A BETTER FINANCIAL FUTURE

Capitalizing on the Promise of Bitcoin

Coinme was founded in 2014 with a mission to be the world’s trusted gateway to digital currency and a better financial future. CEO and co-founder Neil Bergquist saw bitcoin’s potential to provide access to an alternative store of value and medium of exchange for the digital era. When Coinme launched, a single bitcoin was worth about $400.

Before Neil could give people trusted access to bitcoin, he needed to collaborate with regulators to define its regulatory environment. Neil quickly learned about the Bank Secrecy Act and the U.S. Patriot Act, which provide the framework for anti-money laundering laws in the U.S. He also educated himself about state-level money transmission laws.

After investing what little money he had, Neil partnered with his co-founder, Michael Smyers, to establish Coinme and apply for a first-of-its-kind virtual currency money transmitter license.

Crypto Compliance and Confronting the Unknowns

After several months of expensive collaboration with the Washington State Department of Financial Institutions, Coinme received a state-issued money transmitter license in April 2014. A few weeks later, on May 1, 2014, Coinme launched the first licensed bitcoin ATM in the U.S., one of the first ten bitcoin ATMs to be deployed globally.

Early on, there were a lot of unknowns, including if bitcoin would be outlawed or if people would even use a bitcoin ATM. Operational challenges abounded, such as trying to obtain a bank account. Banks were wary of supporting a bitcoin exchange, especially one that used cash as its primary payment method. Additionally, no armored car service would agree to manage cash from the ATMs.

As a result, Neil and a few early employees took turns visiting the ATMs after hours with backpacks and street clothes to avoid attention while handling six figures in cash. This arrangement continued until an armored car service finally agreed to work with the company—four years after its founding.

In the beginning, Coinme relied on bootstrap funding and endured consistent financial losses. Neil did not collect a salary for the first three years, working a day job as a management consultant to support himself while building Coinme in the evenings. Neil and his wife, Anna, who is also a business partner, sold their primary residence in Seattle to fund the company during one of bitcoin’s downturns. These funds kept critical team members employed.

In addition to personally guaranteeing credit cards and taking out high-interest loans, Neil, Anna, and Michael Smyers sacrificed extensively to ensure Coinme’s survival. Their perseverance paid off when Coinme secured a $1 million investment in Q1 2017, just as the company’s bank account dwindled to $7. Coinme grew its bitcoin ATM network to 75 locations across the western United States before pivoting to a model that crypto-enables existing financial infrastructure.

The Pivot to Crypto-Enabling Financial Services

Coinme realized the quickest way to drive bitcoin mass adoption was by integrating with existing financial infrastructure. The company pivoted from operating bitcoin ATMs to “crypto-enabling” legacy financial services through an API and its nationwide portfolio of licenses.

In January 2019, Coinme partnered with Coinstar, establishing Coinme-enabled Coinstar kiosks in grocery stores nationwide to enable crypto purchases with cash. At launch, bitcoin was trading at about $3,200. In May 2021, Coinme partnered with MoneyGram to “crypto-enable” select agent locations in the U.S., allowing the purchase or sale of crypto with cash.

Coinme expanded beyond bitcoin in August 2022, adding seven other cryptocurrencies, including Ethereum, Litecoin, and Dogecoin. The company also launched a Crypto-as-a-Service API to crypto-enable digital platforms. In October 2022, Coinme announced it powered MoneyGram’s new crypto service via the MoneyGram App.

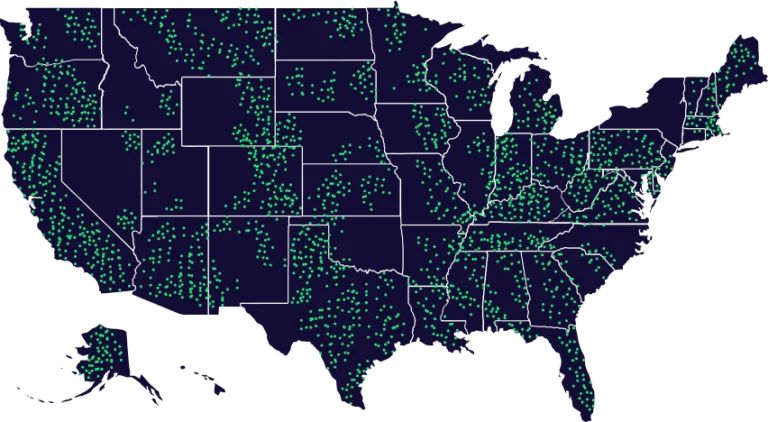

By March 2023, Coinme partnered with its first cash pickup ATM network, scaling to over 40,000 locations in the U.S. to buy and sell crypto with cash. Today, it is the largest cryptocurrency cash network in the world.

The Impact of Coinme and What the Future Holds

Coinme has solved the need for user-friendly access to crypto. Today, nearly 90% of the U.S. population lives within five miles of a Coinme-enabled location. Thanks to its pioneering approach, thousands of people have benefited from secure access to bitcoin, even when it was trading as low as $220.

The company continues to execute its vision of providing everyone with simple, accessible, and affordable access to crypto through existing financial services. Coinme is committed to making crypto a part of daily life as a tool for payments, remittances, and investing.